HSBC India Export Opportunities Fund NFO Company Profile:

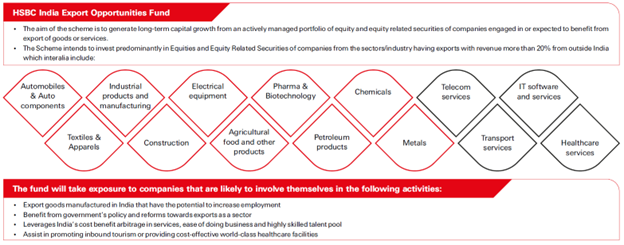

HSBC India Export Opportunities Fund aims to capture the growth in exports. The thematic scheme intends to invest predominantly in Equities and Equity Related Securities of companies from the sectors/industry having exports revenue more than 20 per cent from outside India. The fund aims to invest 80 per cent to 100 per cent of the assets in companies that have exports revenue of more than 20 per cent. The fund also has flexibility to invest up to 20 per cent asset in other equities and equity related securities. This thematic fund is one of the unique offerings in the industry having this differentiated allocation structure.

(source:https://www.assetmanagement.hsbc.co.in/)

HSBC India Export Opportunities Fund NFO Details:

| Mutual Fund | HSBC Mutual Fund |

| Scheme Name | HSBC India Export Opportunities Fund |

| Objective of Scheme | The investment objective of the scheme is to generate long-term capital growth from an actively managed portfolio of equity and equity related securities of companies engaged in or expected to benefit from export of goods or services. There is no assurance that the objective of the scheme will be realised and the scheme does not assure or guarantee any returns. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Sectoral/ Thematic |

| New Fund Launch Date | 05-Sep-2024 |

| New Fund Earliest Closure Date | 19-Sep-2024 |

| New Fund Offer Closure Date | 19-Sep-2024 |

| Indicate Load Seperately | Exit Load: i. If the units redeemed or switched out are upto 10% of the units purchased or switched in (“the limit”) within 1 year from the date of allotment – Nil ii. If units redeemed or switched out are over and above the limit within 1 year from the date of allotment – 1% iii. If units are redeemed or switched out on or after 1 year from the date of allotment – Nil. |

| Minimum Subscription Amount | 5000 |

(source:amfindia)

Scheme Documents

HSBC India Export Opportunities Fund NFO Investment Focus*:

Why HSBC India Export Opportunities Fund?

HSBC India Export Opportunities Fund (HEOF) aims to benefit from the India’s export growth and can provide below advantages.

- Indian export has grown 10 per cent CAGR compared to pre-Covid era, 1.7x of nominal GDP growth

- By 2030 India’s target for Export is USD 2tn which reflects strong 15 per cent CAGR

- India offers some distinct driving factors for export growth such as cost-effective skilled labour and government reforms

- HSBC India Export Opportunities Fund (HEOF) aims to capture this growth trend by investing in export-oriented companies having export revenue of more than 20 per cent. The fund will invest 80 per cent to 100 in such companies

- Along with proven stock selection process (SAPM), HEOF will also filter companies based on our 4C evaluation viz. Company MOAT, Corporate Governance, Cash Flows and comparative valuations

(source:https://www.assetmanagement.hsbc.co.in/)

HSBC India Export Opportunities Fund NFO Riskometer: