Tata Nifty India Tourism Index Fund NFO:

India’s travel and tourism segment is on an exciting ascent. Rising disposable incomes, a growing middle income group, and government-led infrastructure initiatives and increased route capacity are fueling India’s travel appetite. This dynamic environment presents an investment opportunity related to the Tourism sector that has a cascading effect on industries such as Hospitality, Food and Aviation industries. Many Indians are taking multiple trips a year and prioritizing experience travel. Be it travel for business, leisure, or medication, India is bulking ammunition to travel by ease of convenience, affordability and enhancing infrastructure and route amplitude.

(source: tatamutualfund.com)

Portfolio Positioning and Construction:

The index aims to replicate the Nifty India Tourism Index. The Index methodology is as follows:

- Eligible universe for the index entails Nifty 500 constituents that belong to the following basic industries:

1.Hotel & Resorts

2.Tour, Travel Related Services

3.Restaurants

4.Airline

5.Airport & Airport services

6.Apart from the above basic industries companies which are into manufacturing of trolley bags, suitcases, luggage are eligible to be included in the index. - The Index can consist of a maximum of 30 stocks with a weight cap of 20%

- The index is reviewed Semi Annually (March and September) and rebalanced quarterly (March, June, September and December) basis Free Float Market Capitalization.

(source: tatamutualfund.com)

Tata Nifty India Tourism Index Fund NFO Details:

| Mutual Fund | Tata Mutual Fund |

| Scheme Name | Tata Nifty India Tourism Index Fund |

| Objective of Scheme | The investment objective of the scheme is to provide returns, before expenses, that commensurate with the performance of Nifty India Tourism Index (TRI), subject to tracking error. However, there is no assurance or guarantee that the investment objective of the scheme will be achieved. The scheme does not assure or guarantee any returns. |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme – Index Funds |

| New Fund Launch Date | 08-Jul-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 19-Jul-2024 |

| Indicate Load Seperately | Entry Load: Not Applicable Exit Load: 0.25% of the applicable NAV, if redeemed on or before 15 days from the date of allotment. Exit load (if any) charged to the unit holders by the Mutual Fund on redemption (including switch-out) of units shall be credited to the scheme net of GST. GST on exit load, if any, shall be paid out of the exit load proceeds. load, if any, |

| Minimum Subscription Amount | Rs. 5000/- |

| For Further Details Please Visit Website | https://www.tatamutualfund.com |

(source :amfiindia)

Scheme Documents

(source: tatamutualfund.com)

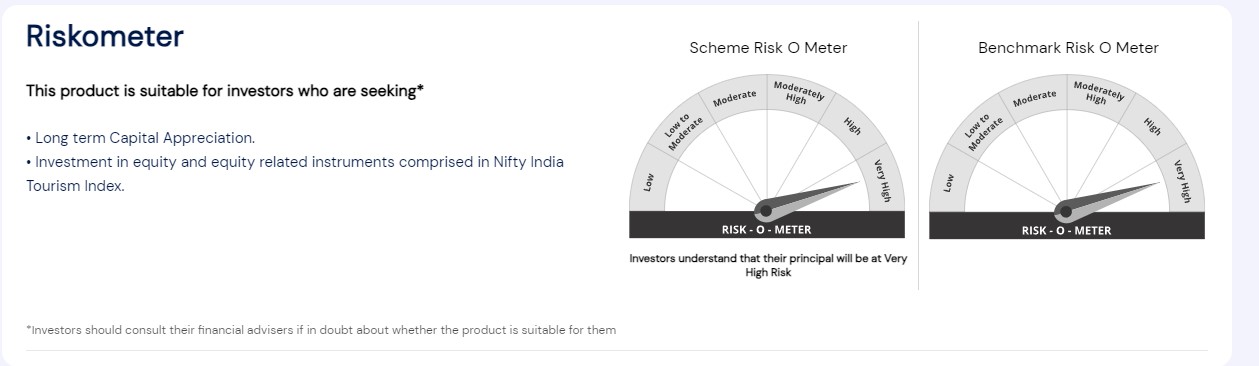

Tata Nifty India Tourism Index Fund NFO Risk-o-meter: