Afcons Infrastructure Limited IPO Company Profile:

Afcons Infrastructure Limited is a prominent international infrastructure construction company based in Mumbai, India. Established in 1959 as a partnership between Rodio Foundation Engineering Limited, Switzerland, and Hazarat & Company, India, the company has a long history of delivering complex infrastructure projects. Originally known as Rodio Hazarat and Company, it evolved over the decades, incorporating as a private limited company in 1976 and later transitioning to a public limited company under its current name in 1996. Afcons is a subsidiary of the Shapoorji Pallonji Group, a major construction conglomerate in India. The company operates across various segments, including transportation, marine, industrial, and urban infrastructure. It is renowned for its expertise in executing challenging projects in diverse environments, from urban metros to remote regions, contributing significantly to India’s infrastructure development.

The company’s values emphasize safety, integrity, teamwork, and customer satisfaction. Afcons is committed to upholding high standards of safety and quality in all its operations, ensuring that projects are completed efficiently and responsibly. Integrity is at the core of its business practices, promoting transparency and ethical conduct. Teamwork is fostered across all levels of the organization, encouraging collaboration and innovation to overcome complex engineering challenges. Customer satisfaction is prioritized through a customer-centric approach, striving to meet and exceed client expectations. Afcons dedication to these values has cemented its reputation as a reliable and forward-thinking infrastructure company, playing a crucial role in shaping India’s infrastructure landscape and expanding its footprint internationally

Afcons Infrastructure Limited IPO Key Numbers:

- Year Established: 1959

- Subsidiary of: Shapoorji Pallonji Group

- Employee Strength: Over 3,000

- Projects Completed: Over 350 across various infrastructure segments

- Revenue (FY 2022): ₹50,000 million

- Order Book (as of 2023): ₹100,000 million

Afcons Infrastructure Limited IPO Business Operations:

Afcons operates across several infrastructure segments:

Transportation Infrastructure

This segment includes roads, highways, bridges, tunnels, railways, and metro systems.

- Projects Completed: Over 150 major transportation projects.

- Key Projects:

- Bandra-Worli Sea Link: An iconic 5.6 km bridge in Mumbai.

- Chennai Metro Rail Project: A significant urban transit system.

- Eastern Peripheral Expressway: A major highway project around Delhi.

- Revenue Contribution (FY 2022): ₹20,000 million (40% of total revenue).

Marine Infrastructure

Afcons specializes in port and harbour construction, offshore oil and gas infrastructure, and coastal defence projects.

- Projects Completed: Over 70 major marine projects.

- Key Projects:

- Ennore LNG Terminal: A critical facility for India’s energy needs.

- Mumbai Port Expansion: Enhancing port capacity and efficiency.

- Vizhinjam Port: A major port development project in Kerala.

- Revenue Contribution (FY 2022): ₹15,000 million (30% of total revenue).

Industrial Infrastructure

The company undertakes construction projects for industrial plants, including refineries, petrochemical facilities, and power plants.

- Projects Completed: Over 50 major industrial projects.

- Key Projects:

- Reliance Jamnagar Refinery Expansion: One of the largest refineries in the world.

- ONGC Petro Additions Limited (OPaL): A significant petrochemical complex.

- NTPC Power Plants: Multiple power plant projects across India.

- Revenue Contribution (FY 2022): ₹10,000 million (20% of total revenue).

Urban Infrastructure

Afcons is involved in urban development projects, including water supply systems, sewage treatment plants, and urban transportation systems.

- Projects Completed: Over 80 major urban infrastructure projects.

- Key Projects:

- Mumbai Sewage Treatment Plants: Enhancing urban sanitation.

- Bangalore Water Supply and Sewerage Project: Improving urban water management.

- Kolkata East-West Metro Corridor: A crucial urban transit project.

- Revenue Contribution (FY 2022): ₹5,000 million (10% of total revenue).

Afcons Infrastructure Limited IPO Pre-Offer Shareholding of the selling shareholders:

| S

No. |

Name of Shareholder | Pre-Offer | |

| Number of Equity Shares | Percentage of total pre-Offer paid up Equity Share capital | ||

| Promoters | |||

| 1. | Goswami Infratech Private Limited* | 246,540,258 | 72.35 |

| 2. | Shapoorji Pallonji and Company Private Limited | 56,681,410 | 16.64 |

| 3. | Floreat Investments Private Limited | 27,667,944 | 8.12 |

| Total (A) | 330,889,612 | 97.11 | |

| Promoter Group | |||

| 4. | Hermes Commerce Private Limited | 4,054,970 | 1.19 |

| 5. | Renaissance Commerce Private Limited | 4,024,619 | 1.18 |

| Total (B) | 8,079,589 | 2.37 | |

| Total of Promoter & Promoter Group (A) + (B) | 338,969,201 | 99.48 | |

Afcons Infrastructure Limited IPO Details:

| IPO Open Date | [.] |

| IPO Close Date | [.] |

| Listing Date | [.] |

| Face Value | ₹10 per share |

| Price | [.] to [.] per share |

| Lot Size | [.] |

| Issue Size | [.] Shares (aggregating up to [.] Cr) |

| Fresh Issue | Up to [●] Equity Shares aggregating up to ₹ 12,500 million |

| Offer for Sale | Up to [●] Equity Shares aggregating up to ₹ 57,500 million |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| QIB Shares Offered | Not more than 50% of the Net Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Net Offer |

| Retail Shares Offered | Not less than 35% of the Net Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Afcons Infrastructure Limited IPO Allotment Status

Afcons Infrastructure Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

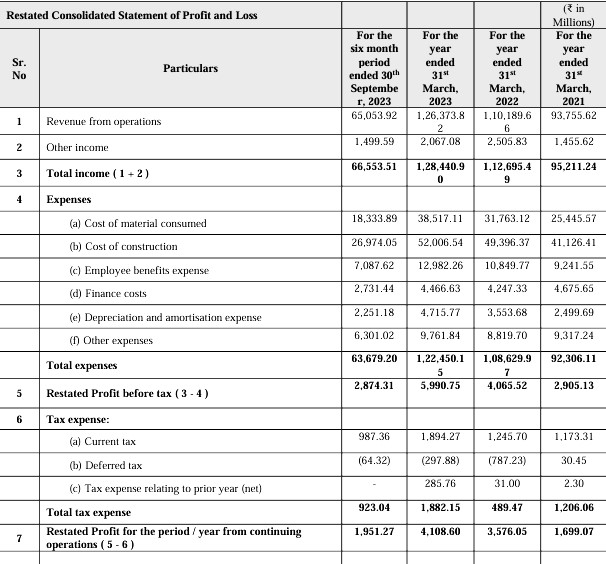

Afcons Infrastructure Limited IPO Profit & Loss Analysis:

Afcons Infrastructure Limited IPO Strengths:

Technical Expertise: Afcons has a proven track record of completing complex projects in challenging environments, demonstrating strong technical capabilities. Over the past decade, Afcons has successfully executed more than 150 major projects, including the construction of the iconic Bandra-Worli Sea Link in Mumbai and the Chennai Metro Rail Project, showcasing its ability to handle high-stakes projects efficiently.

- Diversified Portfolio: The company’s operations across multiple infrastructure segments reduce dependency on any single sector, providing financial stability and growth opportunities. For instance, in the fiscal year 2022, transportation projects contributed 40% to the company’s revenue, marine projects 30%, industrial projects 20%, and urban infrastructure 10%. This diversification ensures that Afcons is not overly reliant on any single market segment.

- Reputation and Reliability: Being a part of the Shapoorji Pallonji Group, Afcons enjoys a reputation for reliability, quality, and timely project delivery. The company’s consistent performance has led to repeat business from prestigious clients such as the National Highways Authority of India (NHAI), Indian Railways, and major private sector companies. The timely delivery of the Kolkata East-West Metro Corridor is a testament to Afcons reliability.

- Experienced Workforce: Afcons boasts a skilled and experienced workforce, including engineers and project managers who bring innovative solutions to infrastructure challenges. The company employs over 1,500 engineers and project managers, with an average experience of 15 years in the industry. Continuous training programs and a focus on innovation ensure that the workforce remains at the forefront of industry developments.

- Strong Client Relationships: The company has built lasting relationships with government bodies, private clients, and international organizations, ensuring a steady pipeline of projects. Afcons client retention rate stands at an impressive 85%, with many clients returning for subsequent projects. This strong network has led to strategic partnerships and collaborations, bolstering Afcons market position.

Afcons Infrastructure Limited IPO Risks:

Market Risks: The infrastructure sector is highly dependent on government policies, economic conditions, and budget allocations. Any adverse changes can impact project availability and funding.

- Execution Risks: Infrastructure projects are complex and face risks related to project delays, cost overruns, and technical challenges. Effective project management is crucial to mitigate these risks.

- Regulatory Risks: Compliance with local and international regulations, environmental laws, and safety standards is essential. Non-compliance can lead to legal issues and project stoppages.

- Financial Risks: High capital investment in infrastructure projects requires substantial financing. Economic downturns or financial instability can affect the company’s liquidity and access to capital.

- Competition: The infrastructure construction industry is highly competitive, with numerous players vying for contracts. Intense competition can impact profit margins and market share.

- Geopolitical Risks: For international projects, geopolitical instability in certain regions can pose risks related to safety, regulatory changes, and market access.

Afcons Infrastructure Limited IPO Objects of the offer:

Funding Working Capital Requirements:

- Purpose: Finance working capital for ongoing and future projects.

- Allocation: Significant portion of proceeds.

Debt Repayment:

- Purpose: Reduce debt burden and strengthen financial stability.

- Allocation: Part of proceeds for loan repayment.

Capital Expenditure:

- Purpose: Invest in new technology, equipment, and infrastructure.

- Allocation: Funds for new machinery and upgrades.

General Corporate Purposes:

- Purpose: Cover corporate expenses, including administrative costs and business development.

- Allocation: Portion reserved for flexibility in financial planning.

Expansion into New Markets:

- Purpose: Finance entry into new geographical markets.

- Allocation: Investment in market research, partnerships, and initial project funding.

Afcons Infrastructure Limited IPO

Prospectus:

- Afcons Infrastructure Limited IPO – https://www.sebi.gov.in/filings/public-issues/apr-2024/afcons-infrastructure-limited_13596.html

Registrar to the offer:

Link Intime India Private Limited

C-101, 1st Floor, 247 Park L.B.S. Marg, Vikhroli (West) Mumbai 400 083 Maharashtra, India

Telephone: +91 810 811 4949

E-mail: afconsinfrastructure.ipo@linkintime.co.in

Website: www.linkintime.co.in