SRM Contractors IPO Company Details:

SRM Contractors Limited (SRMCL) is an engineering, construction, and development firm that works on various civil construction projects, including building roads, tunnels, and stabilizing slopes. It accepts subcontracting jobs from other infrastructure developers as well. All of SRM’s projects are situated in the Union Territories Jammu & Kashmir and Ladakh. Consequently, the Company is able to carry out projects in the region’s difficult and hilly terrain. It is listed with the Jammu & Kashmir Public Works Department as a Class A contractor. SRMCL is eligible to submit an independent bid for projects worth up to Rs. 500 Cr for tunnel construction and Rs. 300 Cr for EPC contracts that are put out by the government. Since its inception, the company has completed 37 infrastructure projects totaling Rs. 771 Cr., either on its own or through certain joint ventures. Thirty-one road projects, three tunnel projects, one slope stabilization project, and two other civil operations are among them. As of September 15, 2023, the Company’s order book, which comprises both individual and subcontracting projects, was valued at Rs. 707 Cr. Together, these represent a total of 21 projects, consisting of 12 construction projects for roads, 5 tunnels, 3 road stabilization projects, and 1 other civil activity.

| IPO-Note | SRM Contractors Limited |

| Rs.200 – Rs.210 per Equity share | Recommendation: Apply for long-term |

SRM Contractors IPO Details :

| Issue Details | |

| Objects of the issue | · To fund capital expenditure

· To pay borrowings · To fund working capital requirements |

| Issue Size | Total issue Size – Rs.130.20 Cr.

Fresh Issue – Rs.130.20 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.200 – Rs.210 |

| Bid Lot | 70 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 26th March, 2024 – 28th March, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

SRM Contractors IPO Strengths:

-

The company has a track record of successfully completing projects involving slope stabilization, highways, and tunnels in the difficult terrain of Jammu & Kashmir.

-

The company chooses contracts for several projects that are next to one another. Thus, it aids in maximizing profitability and lowering transportation costs.

-

The ability of the company to control costs and grow revenue consistently, hence maximizing profitability, are key performance indicators. It is supported by an order book twice as large as its current income. This ought to provide insight into the consistent revenue over the ensuing two years.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check SRM Contractors IPO Allotment Status

SRM Contractors IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

SRM Contractors IPO Risk Factors:

-

SRMCL’s business is primarily concentrated in J&K and Ladakh. The region of operation is always prone to regional civil unrest, political instability, and adverse climate amongst many reasons. Any adverse event can significantly hinder the Company’s progress.

-

Top 5 clients of the company contribute to ~72% of its revenue, loss of any such client may impact company’s performance and financials.

-

Company needs to follow competitive bidding process.

-

The company derives majority of its revenues from construction of Roads, Tunnel and Slope Stabilisation work any failure to obtain new Roads, Tunnel and slope stabilisation work may affect company’s business.

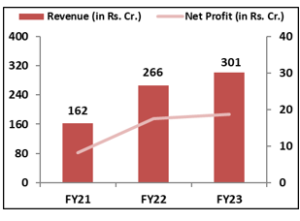

SRM Contractors IPO Financial Performance:

SRM Contractors IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 99.92% | 72.92% |

| Others | 0.08% | 27.08% |

SRM Contractors IPO Outlook:

SRMCL is a construction company engaged in the specialized engineering construction of roads, tunnels, slop stabilization etc. The company has been reporting steady growth it its revenue and profits with strong order book of 720 cr. counting 2.4x book to bill ratio. The PE of SRMCL stands at 24x on the upper price band which seems fully priced in when compared to its peer’s average of 32.15x. Considering its financial performance, order book and future growth prospect, we recommend investors to apply to the offering for long term horizon.

SRM Contractors IPO FAQ

Ans. SRM Contractors IPO is a main-board IPO of 6,200,000 equity shares of the face value of ₹10 aggregating up to ₹130.20 Crores. The issue is priced at ₹200 to ₹210 per share. The minimum order quantity is 70 Shares.

The IPO opens on March 26, 2024, and closes on March 28, 2024.

Bigshare Services Pvt Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The SRM Contractors IPO opens on March 26, 2024 and closes on March 28, 2024.

Ans. SRM Contractors IPO lot size is 70 Shares, and the minimum amount required is ₹14,700.

Ans. The SRM Contractors IPO listing date is not yet announced. The tentative date of SRM Contractors IPO listing is Wednesday, April 3, 2024.

Ans. The minimum lot size for this upcoming IPO is 70 shares.