Divgi Torqtransfer Systems IPO Company Profile:

Divgi Torqtransfer Systems Limited (“DTSL”) is amongst the very few automotive component entities in India that have the capability to develop and provide system-level transfer cases, torque couplers, and dual-clutch automatic transmissions (“DCT”) solutions. The company is one of the leading players that supply transfer case systems to automotive OEMs in India and also is the largest supplier of transfer case systems to passenger vehicle (“PV”) manufacturers in India. DTSL is the single player that manufactures and exports transfer cases to global OEMs from India and is the only manufacturer of torque couplers in India. The company also has the capability to develop and provide transmission systems for EVs (“electric vehicles”).

| IPO-Note | Divgi TorqTransfer Systems Limited |

| Rs.560 – Rs.590 per Equity share | Recommendation: Aggressive investors may apply |

DTSL manufactures and supplies a variety of products under broad categories that include:

- Torque transfer systems (which include four-wheel-drive (“4WD”) and all-wheel-drive (“AWD”) products)

- Synchronizer systems for manual transmissions and DCT

- Components for the above-mentioned product categories for torque transfer systems and synchronizer systems in manual transmission, DCT, and EVs.

DTSL has also developed:

- Transmission systems for EVs

- DCT systems

- Rear wheel drive manual transmissions

DTSL has three manufacturing and assembling facilities in India located at Shivare and Bhosari near Pune in Maharashtra, and Sirsi in Karnataka with the manufacturing facilities at Shivare and Bhosari being strategically located in proximity to its key clients, and one manufacturing facility is under-construction located at Shirwal.

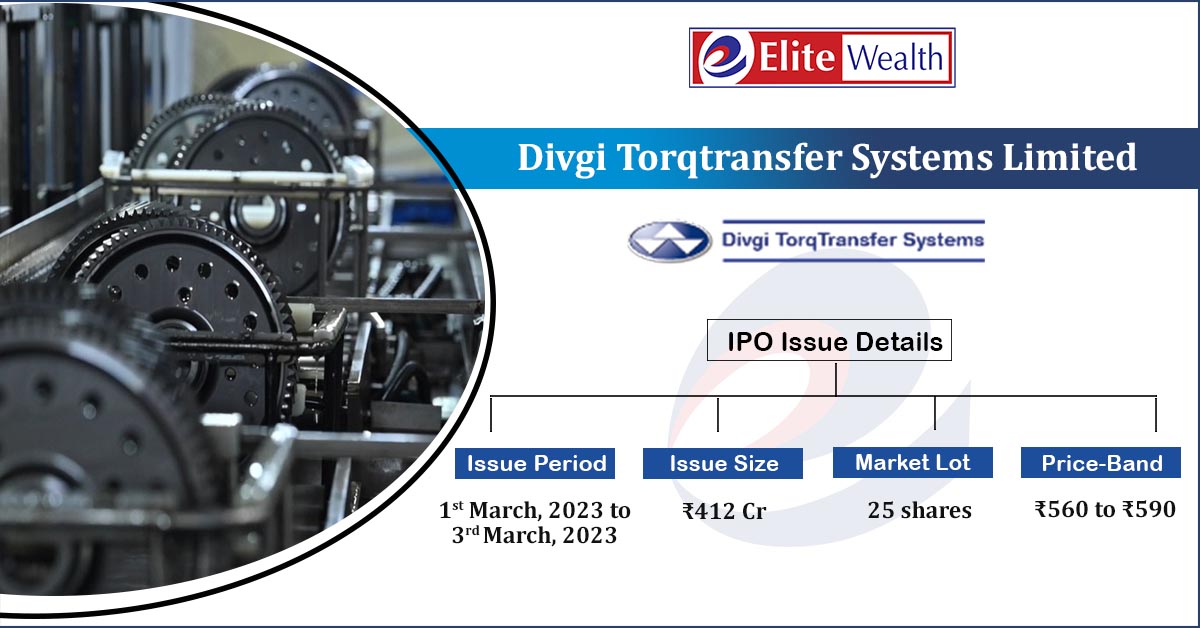

Divgi Torqtransfer Systems IPO Details:

| IPO Open Date | 1st March, 2023 |

| IPO Close Date | 3rd March, 2023 |

| Listing Date | 14th March, 2023 |

| Face Value | ₹5 per share |

| Price | ₹560 to ₹590 per share |

| Lot Size | 25 Shares |

| Issue Size | 6,985,090 Shares

(aggregating up to ₹412 Cr) |

| Fresh Issue | 3,050,847 shares

(aggregating up to ₹180 Cr) |

| Offer For Sale | 3,934,243 shares

(aggregating up to ₹232 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| QIB Shares Offered | Not more than 75% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

| Retail Shares Offered | Not less than 10% of the Offer |

| Promoters | Jitendra Bhaskar Divgi, Hirendra Bhaskar Divgi and Divgi Holdings Private Limited |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Divgi Torqtransfer Systems IPO Allotment Status

Go Divgi Torqtransfer Systems IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Divgi Torqtransfer Systems IPO Financial Analysis :

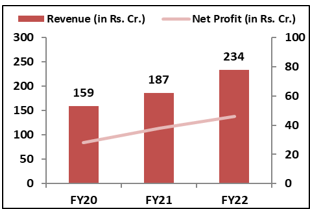

| Particulars | 6M of FY-23(in cr.) | FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | CAGR |

| Revenue from Operations | 133.72 | 233.78 | 186.58 | 159.07 | 13.7% |

| Other Income | 3.83 | 8.10 | 8.45 | 11.68 | |

| Cost of Goods Sold | 54.97 | 93.63 | 66.96 | 58.21 | 17.2% |

| Employee Cost | 13.28 | 22.54 | 21.77 | 19.65 | |

| Other expenses | 28.38 | 51.99 | 45.94 | 44.27 | |

| EBITDA | 40.92 | 73.71 | 60.35 | 48.61 | 14.9% |

| EBITDA margin% | 30.60% | 31.53% | 32.35% | 30.56% | |

| Depreciation | 6.28 | 11.39 | 7.61 | 6.39 | |

| Interest | 0.14 | 0.17 | 0.18 | 4.46 | |

| Profit / (loss) before tax | 34.50 | 62.15 | 52.56 | 37.76 | 18.1% |

| Total tax | 8.84 | 16.00 | 14.51 | 9.72 | |

| PAT | 25.66 | 46.15 | 38.04 | 28.04 | 18.1% |

| PAT margin% | 19.19% | 19.74% | 20.39% | 17.63% |

Shareholders of Divgi Torqtransfer Systems Limited:

| S.NO. | Name of the Shareholder | No. of Shares | % of pre-Offer shareholding |

| 1 | Jitendra Bhaskar Divgi | 730,680 | 2.65% |

| 2 | Hirendra Bhaskar Divgi | 732,480 | 2.66% |

| 3 | Divgi Holdings Private Limited | 15,782,680 | 57.32% |

| 4 | Jayashri Mohan Divgi | 712,800 | 2.59% |

| 5 | Suraj Sanjay Divgi | 269,280 | 0.98% |

| 6 | Harshvardhan Bharat Divgi | 269,280 | 0.98% |

| 7 | Oman India Joint Investment Fund II | 5,977,360 | 21.71% |

| 8 | NRJN Family Trust | 2,394,720 | 8.70% |

| 9 | Kishore Mangesh Kalbag | 44,800 | 0.16% |

| 10 | Bharat Bhalchandra Divgi | 1,97,720 | 0.72% |

| 11 | Ashish Anant Divgi | 2,08,040 | 0.76% |

| 12 | Arun Ramdas Idgunji | 44,800 | 0.16% |

| 13 | Sanjay Bhalchandra Divgi | 1,61,840 | 0.59% |

| Total | 27,526,480 | 99.98% |

Divgi Torqtransfer Systems IPO Offer for Sale Details:

| S. No. | Name of the Selling Shareholder | Number of Equity Shares

being offered in the Offer for Sale (Up to) |

|

| 1. | Oman India Joint Investment Fund II | 22,50,000 Equity Shares | |

| 2. | NRJN Family Trust | 14,41,441 Equity Shares | |

| 3. | Bharat Bhalchandra Divgi | 49,430 Equity Shares | |

| 4. | Sanjay Bhalchandra Divgi | 40,460 Equity Shares | |

| 5. | Ashish Anant Divgi | 104,020 Equity Shares | |

| 6. | Arun Ramdas Idgunji | 33,660 Equity Shares | |

| 7. | Kishore Mangesh Kalbag | 15,232 Equity Shares | |

Divgi Torqtransfer Systems IPO Financial Performance:

Divgi Torqtransfer Systems IPO Strengths:

- One of the very few suppliers in India having the capability to develop and provide system-level transfer cases, torque couplers, DCT solutions, and transmission systems for EVs across a wide array of automotive vehicles and geographies, with leadership across select product categories

- DTSL’s facilities are equipped with advanced machinery and certain of the facilities are located in close proximity to its key customers to enable meeting the customers’ demand schedules and logistical advantages for the customers, and to insulate them from local suppliers or other disruptions.

- DTSL has strong and well-established relationships with several marquee domestic and global OEMs in the automobile sector such as Tata Motors, Mahindra & Mahindra, and with global suppliers such as BorgWarner. For instance, the company has been in continuous business with BorgWarner, Tata Motors and Mahindra & Mahindra for over two decades. Its being positioning as a system and solution provider entrenches it into the OEM eco-system, reduces the risk of purely price-based competition, and aids it to develop a deeper interface with its customers’ product development and senior management teams.

- DTSL is led by a highly experienced board of directors, and a professional and experienced management team with extensive experience in the automotive industry. The company’s promoters Jitendra Bhaskar Divgi and Hirendra Bhaskar Divgi, are mechanical engineers with considerable experience in the automotive industry. Jitendra Bhaskar Divgi, the Managing Director and Promoter, has a Master of Science degree in manufacturing from the University of Massachusetts, USA. Hirendra Bhaskar Divgi, the Whole-Time Director and Promoter, has over 30 years of experience in advanced gear manufacturing processes and their influence in driving train products while working as the development manager in the Company.

Divgi Torqtransfer Systems IPO Risk Factors:

- DTSL is a business-to-business (B2B) manufacturing company with an asymmetric dependence on a few customers. The company derives a significant portion of its revenue from the top five customers, namely, Mahindra & Mahindra, Tata Motors, Toyota Kirloskar Auto Parts, BorgWarner, and a Russian automobile manufacturer. Further, it is highly dependent on the revenue generated from Customer 1. The company derived a significant portion of its revenue from operations, i.e., ₹988.45 million or 73.92% for the six months period ended September 30, 2022, from Customer 1.

- DTSL uses a variety of raw materials and commodities (including aluminium, copper, nickel, plastic resins, steel, other raw materials, and energy) and materials purchased in various forms such as peeled alloy steel bars, aluminium castings, steel forgings, magnets, steel and brass stampings, and plastic components in the production of the components. The company’s business could be adversely affected by volatility in the price or availability of raw materials and components.

- DTSL depends on some third-party suppliers for certain key components and raw materials used for manufacturing the systems and components. A disruption in the supply of these key components and raw materials and the failure of the suppliers and third-party logistics service providers to meet their obligations could impact its on-time supplies and input cost if resourced from other suppliers.

- If DTSL is unable to anticipate, identify, understand, and respond timely to rapidly evolving technological and market trends and preferences, develop new products to meet its customers’ demands and to adapt to major changes and shifts in the automotive market, the business may be materially adversely affected.

Objects of the Offer:

DTSL proposes to utilize the Net Proceeds from the Fresh Issue towards the following objects:

- Funding capital expenditure requirements for the purchase of equipment/machinery of the manufacturing facilities(“Capital Expenditure”); and

- General corporate purposes.

Divgi Torqtransfer Systems Limited IPO Prospectus:

- Divgi Torqtransfer Systems Limited IPO DRHP- https://www.sebi.gov.in/filings/public-issues/sep-2022/divgi-torqtransfer-systems-limited-drhp_63303.html

- Divgi Torqtransfer Systems Limited IPO RHP-

Registrar to the offer:

Link Intime India Private Limited

Telephone: 022 49186200

E-mail: divgi.ipo@linkintime.co.in

Investor grievance E-mail: divgi.ipo@linkintime.co.in

Website: www.linkintime.co.in

Contact Person: Shanti Gopalkrishnan

SEBI Registration No.: INR000004058

Divgi TorqTransfer Systems IPO FAQ

Ans.Divgi TorqTransfer Systems IPO will comprise fresh share issue and new offer share issue. The company aims to go public to accelerate its growth and expansion plan.

Ans. The company will open for subscription on Mar 1, 2023 to Mar 3, 2023.

Ans. The minimum lot size that investors can subscribe to is 25 shares.

Ans. The Divgi TorqTransfer Systems IPO listing date is Mar 14, 2023

Ans. The minimum lot size for this upcoming IPO is 25 shares.