Mirae Asset Global Investments was founded in Asia and now has a presence in 13 countries, where the company takes a collaborative approach in managing a fully diversified investment platform. The company is a diversified asset manager providing innovative solutions worldwide to help clients achieve their goals in a rapidly changing world. The company currently invests over $187bn on behalf of clients, giving it the scale and expertise to identify opportunities in an evolving world. (AUM as of September 2022).

Mirae Asset Mutual Fund is coming up with Mirae Asset Flexi Cap Fund, an NFO scheme with an investment objective to provide long-term capital appreciation from a portfolio investing predominantly in Indian equity and equity-related instruments across market capitalization. However, there can be no assurance that the investment objective of the Scheme will be achieved. The scheme opens on the 3rd of February, 2023, and closes on the 17th of February, 2023.

Mirae Asset Flexi Cap Fund (NFO) details:

| Mutual Fund: | Mirae Asset Mutual Fund |

| Scheme Name: | Mirae Asset Flexi Cap Fund |

| Scheme Code: | MIRA/O/E/FCF/23/01/0044 |

| Objective of Scheme: | The investment objective of the scheme is to provide long-term capital appreciation from a portfolio investing predominantly in Indian equity and equity related instruments across market capitalization. However, there is no assurance that the investment objective of the Scheme will be realized. |

| Benchmark: | Nifty 500 TRI |

| Scheme Type: | An open ended dynamic equity scheme investing across large cap, mid cap, small cap stocks |

| Scheme Category: | Flexi Cap Fund |

| New Fund Launch Date: | 3rd February 2023 |

| New Fund Offer Closure Date: | 17th February 2023 |

| Fund Managers: | Mr. Vrijesh Kasera |

| Entry Load: | Not Applicable |

| Exit Load: | · If redeemed within 1 year (365 days) from the date of allotment: 1%

· If redeemed after 1 year (365 days) from the date of allotment: NIL. |

| Minimum Application Amount: | Rs. 5,000 and in multiples of Re. 1/- thereafter |

| Minimum Additional Purchase Amount | Rs. 1000 and in multiples of Re. 1/- thereafter |

Asset Allocation:

| Instrument | Indicative Allocation ( % of assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity and Equity related instruments including equity linked derivatives | 65% | 100% | Very High |

| Debt securities (including securitized debt & debt derivatives) and money market instruments | 0% | 35% | Low to Medium |

| Units issued by REITs & InvITs | 0% | 10% | Medium to High |

Mirae Asset Flexi Cap Fund (NFO) Conclusion:

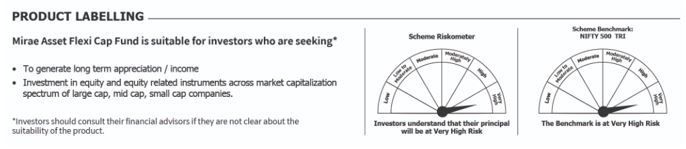

Investing in flexi cap funds provides investors the flexibility to move across market capitalization, Wide diversification of portfolio, and elimination of sectoral bias. However, Investment in mutual fund units involves investment risks such as trading volumes, settlement risks, liquidity risks, and default risks including the possible loss of principal. Therefore, this product is suitable for investors who are seeking Capital appreciation over the long term and investors seeking investment in equity-related instruments across the market capitalization spectrum of large-cap, mid-cap, and small-cap companies. Investors should consult with financial advisers at Elite Wealth if in doubt about whether the product is suitable for them