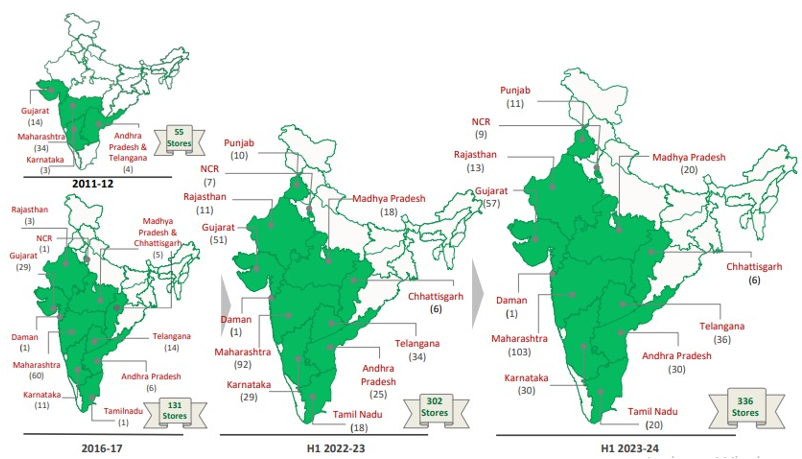

Avenue Supermarts Limited (DMart) is a National supermarket company specialises in value-retailing. With an emphasis on the product categories for general merchandise and apparel, non-foods (FMCG), and foods, we provide a wide range of goods. The company sells its goods in a number of areas, including groceries and basics, dairy and frozen, fruits and vegetables, home and personal care, bed and bath, crockery, footwear, toys and games, children’s clothing, fashion for men and women, and everyday necessities. The company continues to be committed to its strategy, which is founded on the Everyday Low Cost/Everyday Low Price (EDLC/EDLP) approach and involves providing customers with high-quality items at an affordable price. The store offers give consumers a unique shopping experience, including a wide selection of affordable everyday goods presented in a contemporary setting. In 2002, the company opened its first store in Mumbai, Maharashtra. As of September 30, 2023, the company operated 336 stores in the states of Maharashtra, Gujarat, Daman, Andhra Pradesh, Karnataka, Telangana, Tamil Nadu, Madhya Pradesh, Rajasthan, NCR, Chhattisgarh, and Punjab with a total retail business area of 13.9 million square feet.

| Recommendation | PRICE RANGE | Target Price | Time Horizon |

| Buy | Rs. 3871 | Rs. 4600 | 12 Months |

Stock Details |

|

| Market Cap. (Cr.) | 242235.38 |

| Equity (Cr.) | 650.73 |

| Face Value | 10 |

| 52 Wk. high/low | 4602 / 3293 |

| BSE Code | 540376 |

| NSE Code | DMART |

| Book Value (Rs.) | 247.12 |

| Industry | Trading |

| P/E | 101.18 |

Share Holding Pattern % |

|

Promoter |

74.65 |

| FIIs | 8.31 |

| Institutions | 7.70 |

| Non Promoter Corp. | 0.22 |

| Public & Others | 9.13 |

| Government | 0.00 |

| Total | 100.00 |

Key Investment Rationale:

-

D-Mart deploys the Everyday low cost – Everyday low pricing (EDLC-EDLP) approach, which strives to get items at competitive rates, make use of operational and distribution efficiency, and then provide customers with value for money by offering for sale at competitive prices.

-

The management has indicated reasonable certainty that it may not announce material losses and is upbeat about the e-commerce industry. It will emphasize big-basket purchasing through retail pick-up and home delivery channels in the 22 current cities.

-

For the majority of items, the gap between D-Mart Ready and Big Basket (BB) widened in August 2023 as opposed to May 2023, but it varied for D-Mart Ready and Jiomart. Although quick commerce is becoming more prevalent in the grocery and food industries, D-Mart is still the most competitive player in the non-quick commerce market. thanks to:

-

An expanding pricing difference between D-Mart Ready and BB;

-

Growing customer engagement and D-Mart Ready promotion;

-

Increasing delivery fees/higher cart values for free delivery by another channel.

-

-

Larger stores (45k sqft.), which provide the organization the opportunity for further growth, typically mature in four to five years whereas 30-35k sqft. stores typically do so in roughly three years.

-

The general merchandise and apparel category (GM&A) is affected mostly by macroeconomic variables, although the apparel sector is also seeing rising competition. But the damage could be mitigated by additional categories (such as pharmaceuticals, etc.). The tactic of direct purchasing from grocery brands mitigates the impact of GM&A on gross margin.

| State | No. Of Stores |

| Maharashtra | 103 |

| Gujarat | 57 |

| Telangana | 36 |

| Andhra Pradesh | 30 |

| Karnataka | 30 |

| Madhya Pradesh | 20 |

| Tamil Nadu | 20 |

| Rajasthan | 13 |

| Punjab | 11 |

| NCR | 9 |

| Chhattisgarh | 6 |

| Daman | 1 |

Key Product Categories:

| Foods

|

Groceries, staples, processed foods, dairy, frozen products, beverages and confectionery, and fruits & vegetables. |

| Non-Foods (FMCG) | Home care products, personal care products, toiletries, and other over-the-counter products. |

| General Merchandise & Apparel | Bed & bath, toys & games, crockery, plastic goods, garments, footwear, utensils, and home appliances. |

Industry Overview:

Post-COVID Recovery: The fiscal year 2022-23 was a pivotal one for the retail industry in India. After a couple of years of grappling with the impact of the COVID-19 pandemic, the industry finally saw a significant upturn. With the pandemic restrictions lifted and the economy opening up, activities resumed in full swing, leading to robust growth in the retail industry. The growth rate was a strong 15%, taking the total value of the industry to a staggering `84 trillion. This growth was primarily driven by a revival in consumption patterns and improved economic conditions. As the economy recovered, it boosted consumer sentiment, leading to an increase in discretionary spending.

Rise of Organized and E-Retail: The organized retail and e-retail sectors saw substantial growth during this period. Organized retail, which includes large-scale retail outlets and chains, grew by 20% to reach a total value of `9 trillion. This accounted for about 11% of the overall retail industry. E-retail, which includes online shopping platforms, grew at an even faster pace of 24%, reaching a total value of `3 trillion. This represents approximately 3.7% of the total retail industry. A key contributor to this growth was the food and grocery segment, which made up about 25% of the total organized retail industry in value terms.

Future Projections: Looking ahead, the retail industry is expected to maintain this momentum and continue its growth trajectory. The industry is projected to grow at a compounded annual growth rate (CAGR) of 10-11% between 2023 and 2028. This optimistic projection is based on the expectation of continued economic growth and low to moderate inflation rates. As such, the retail industry appears to be on a solid path toward sustained growth and expansion. The industry’s future looks bright, and it is expected to continue to contribute significantly to India’s economic growth.

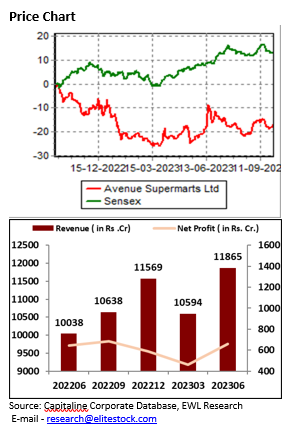

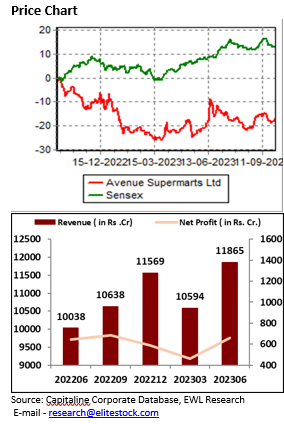

Extract of Q2FY24 Earnings:

-

In 2QFY24, Avenue Supermarts’ (DMART) consolidated/standalone revenue increased 18.7%/18.5 YoY. The revenue increase was mostly driven by 11% YoY store openings. However, revenue/sqft, which had been a laggard, saw a rebound and climbed 6% YoY to Rs8984 during the quarter.

-

Consolidated EBITDA margin fell 40 bp YoY to 8% owing to mix-driven lower gross margin (reduced share of General Merchandise & Apparel (GM&A)) and higher opex.

-

Consolidated PBT increased 13.9% YoY to INR8.5b (a 12% miss). Reported PAT fell 9% YoY, owing mostly to reduced taxes in Q2FY23 due to a tax reversal from the prior period.

-

The shrinking difference between revenue per store and revenue per sq. ft. meant that the percentage of larger-format retailers increased, which remained highly positive. Furthermore, significant store expansions (72% during FY20-23), good cost savings, and a recovery in discretionary demand with the start of the holiday season are expected to boost growth.

-

Employee costs/other expenditures increased 19.1%/17.9% YoY to INR2.2b/INR6.2b in 2QFY24.

-

The GM&A segment’s revenue share decreased to 23.21% in 1HFY24 from 24.75% in 1HFY23, demonstrating a persistent decline in this area.

-

Bill cuts at 147m increased 36% YoY, while the average bill value decreased 13% year on year to INR1,625.

-

LTL sales increased by 8.6%, the highest figure in the previous eight quarters, except Q1FY23 due to the COVID base. The average sales per store climbed by 6.5%, compared to a 4.5% growth in the previous three quarters. Inventory turns increased from 6.7% to 7%.

-

DMART Ready (e-commerce) sales increased by 84% year on year to Rs22 billion in FY20-23. Despite the consistent rise, losses have remained flat year on year. DMART Ready’s sales have expanded 6x between FY20 and FY23, but bottom-line losses have increased 2x, demonstrating that the company’s e-commerce operations are continuously improving.

Quarterly Performance:

| Particulars (In Rs. Cr.) | Q3FY23 | Q2FY23 | Q3FY22 | QoQ% | YoY% | 6MFY23 | 6MFY22 | YoY% |

| Revenue from Operations | 12,624.4 | 11,865.4 | 10,638.3 | 6.4% | 18.7% | 24,489.8 | 20,676.4 | 18.4% |

| Other Income | 36.9 | 38.7 | 35.6 | -4.7% | 3.8% | 75.7 | 64.7 | 16.9% |

| Total Income | 12,661.3 | 11,904.2 | 10,673.9 | 6.4% | 18.6% | 24,565.5 | 20,741.1 | 18.4% |

| Purchase of Stock-in-Trade | 11,318.9 | 10,209.8 | 9,871.8 | 10.9% | 14.7% | 21,528.7 | 18,332.4 | 17.4% |

| Changes in inventories | -547.0 | -146.6 | -842.6 | – | – | -693.6 | -905.6 | – |

| Employee expenses | 224.7 | 206.1 | 188.6 | 9.1% | 19.1% | 430.8 | 368.0 | 17.1% |

| Other Expenses | 622.9 | 560.8 | 528.5 | 11.1% | 17.9% | 1,183.7 | 981.3 | 20.6% |

| EBITDA | 1,004.9 | 1,035.3 | 892.0 | -2.9% | 12.7% | 2,040.2 | 1,900.3 | 7.4% |

| EBITDA Margin (%) | 8.0% | 8.7% | 8.4% | -70 bps | -40 bps | 8.3% | 9.2% | -90 bps |

| Finance Cost | 15.6 | 14.6 | 17.7 | 7.0% | -11.8% | 30.2 | 34.9 | -13.6% |

| Depreciation & Amortization expenses | 174.4 | 162.2 | 162.0 | 7.5% | 7.7% | 336.5 | 306.7 | 9.7% |

| Profit Before Tax (PBT) | 851.9 | 897.3 | 748.0 | -5.1% | 13.9% | 1,749.1 | 1,623.4 | 7.7% |

| Tax | 227.8 | 238.6 | 62.2 | -4.5% | 266.0% | 466.4 | 294.8 | 58.2% |

| Profit After Tax (PAT) | 624.1 | 658.7 | 685.7 | -5.3% | -9.0% | 1,282.8 | 1,328.6 | -3.5% |

| PAT Margin (%) | 4.9% | 5.6% | 6.4% | -70 bps | -150 bps | 5.2% | 6.4% | -120 bps |

| EPS (in Rs.) | 9.58 | 10.14 | 10.58 | -5.5% | -9.5% | 19.72 | 20.51 | -3.85% |

Profit and Loss Statement:

| Particulars (In Rs. Cr.) | FY21 | FY22 | FY23 |

| Revenue from Operations | 24,143.06 | 30,976.27 | 42,839.56 |

| Other Income | 196.21 | 117.49 | 129.34 |

| Total Income | 24,339.27 | 31,093.76 | 42,968.90 |

| Cost of materials consumed | 20,855.56 | 26,891.77 | 36,884.71 |

| Changes in inventories | -300.88 | -494.38 | -500.82 |

| Employee expenses | 536.57 | 616.21 | 746.97 |

| Other Expenses | 1,308.76 | 1,464.17 | 2,071.67 |

| EBITDA | 1,939.3 | 2,616.0 | 3,766.4 |

| EBITDA Margin (%) | 8.0% | 8.4% | 8.8% |

| Finance Cost | 41.65 | 53.79 | 67.41 |

| Depreciation and amortization expenses | 414.16 | 498.08 | 638.87 |

| Profit Before Tax | 1483.45 | 2064.12 | 3060.09 |

| Tax | 384.02 | 571.72 | 681.75 |

| Profit After Tax | 1099.43 | 1492.40 | 2378.34 |

| PAT Margin (%) | 4.6% | 4.8% | 5.6% |

| EPS (in Rs.) | 16.97 | 23.04 | 36.72 |

Key Ratios:

| Key Ratios | FY21 | FY22 | FY23 |

| Debt to Equity | 0.03 | 0.04 | 0.04 |

| Current Ratio | 3.28 | 3.05 | 3.04 |

| ROCE (%) | 12.71 | 15.74 | 20.14 |

| ROE (%) | 9.45 | 11.54 | 15.99 |

| EBITDA Margin (%) | 7.35 | 7.71 | 7.99 |

| PAT Margin (%) | 4.17 | 4.4 | 5.04 |

| Valuation | |||

| P/E | 158.65 | 160.3 | 86.31 |

| P/B | 15.02 | 18.61 | 13.37 |

| EV/EBITDA | 94.2 | 98.1 | 57.47 |

| Market Cap/Sales | 7.1 | 7.8 | 4.8 |

Balance Sheet:

| Particulars (In Rs. Cr.) | FY21 | FY22 | FY23 |

| Assets | |||

| Non-Current Assets | |||

| Property, plant and equipment | 5938.50 | 7770.46 | 9725.61 |

| Right of use assets | 960.24 | 1388.65 | 1504.88 |

| Capital work-in-progress | 1019.59 | 1129.34 | 829.16 |

| Goodwill | 78.27 | 78.27 | 78.27 |

| Intangible assets | 22.22 | 13.61 | 23.18 |

| Investment properties | 9.57 | 9.03 | 8.54 |

| Investments | – | 0.01 | 0.01 |

| Other non-current financial assets | 1109.28 | 1262.70 | 108.55 |

| Income tax assets (net) | 1.63 | 2.28 | 17.50 |

| Deferred tax assets (net) | 0.92 | 1.66 | 1.77 |

| Other Non-Current Assets | 454.62 | 373.78 | 360.43 |

| Total non-current assets | 9595 | 12030 | 12658 |

| Current Assets | |||

| Inventories | 2248.28 | 2742.66 | 3243.48 |

| Investments | 2.95 | 5.93 | 202.19 |

| Trade receivables | 43.58 | 66.89 | 62.16 |

| Cash and cash equivalents | 191.50 | 95.12 | 207.15 |

| Bank Balances | 1254.08 | 203.46 | 1201.18 |

| Other financial assets | 167.91 | 127.46 | 316.77 |

| Other current assets | 152.83 | 201.33 | 215.46 |

| Total current assets | 4,061 | 3,443 | 5,448 |

| Total Assets | 13,656 | 15,473 | 18,106 |

| Equity and Liabilities | |||

| Equity | |||

| Equity Share Capital | 647.77 | 647.77 | 648.26 |

| Other Equity | 11535.94 | 13029.87 | 15,430.44 |

| Total Equity | 12,184 | 13,678 | 16,079 |

| Liabilities | |||

| Non-Current Liabilities | |||

| Lease Liabilities | 312.01 | 507.15 | 476.66 |

| Provisions | 2.45 | 4.87 | 6.41 |

| Deferred Tax Liabilities (Net) | 51.19 | 64.03 | 76.96 |

| Other Non-Current Liabilities | 0.44 | 0.41 | 0.47 |

| Total Non-Current Liabilities | 366 | 576 | 561 |

| Current Liabilities | |||

| Lease Liability | 80.70 | 139.79 | 166.32 |

| Trade payables | 578.13 | 589.20 | 753.79 |

| Other current financial liabilities | 269.78 | 282.92 | 289.46 |

| Other current liabilities | 112.66 | 58.37 | 121.18 |

| Provisions | 40.73 | 36.44 | 50.87 |

| Current tax liabilities (net) | 23.77 | 111.57 | 85.39 |

| Total Current Liabilities | 1,106 | 1,218 | 1,467 |

| Total Liabilities | 1,472 | 1,795 | 2,028 |

| Total Equity and Liabilities | 13,656 | 15,472 | 18,106 |

Cash Flow Statement:

| Particulars (In Rs. Cr.) | FY21 | FY22 | FY23 | 6MFY22 | 6MFY23 |

| Cash Flow from Operating Activities | |||||

| Profit from Operations | 1483 | 2064 | 3060 | 1623 | 1749 |

| Depreciation & Amortizaion | 414.2 | 498.1 | 638.9 | 306.7 | 336.5 |

| Finance Cost | 41.7 | 53.8 | 67.4 | 34.9 | 30.2 |

| Increase/Decrease in Working Capital | -127.1 | -582.5 | -319.9 | -688.2 | -831.8 |

| Others | -175.4 | -100.9 | -107.3 | -57.2 | -67.2 |

| Taxes Paid | -261.6 | -560.3 | -708.9 | -378.4 | -309.7 |

| Net Cash Flow from Operating Activities | 1375 | 1372 | 2630 | 841 | 907 |

| Cash Flow from Investing Activities | |||||

| Fixed Assets Purchased | -2029.4 | -2410.4 | -2405.0 | -975.1 | -1430.3 |

| Free Cash Flow | 919.4 | 1120.9 | 91.9 | 227.0 | 519.9 |

| Net Cash Flow from Investing Activities | -1110 | -1289 | -2313 | -748 | -910 |

| Cash Flow from Financing Activities | |||||

| Proceeds from of exercise of share options | 0.0 | 0.0 | 14.6 | 0.0 | 74.1 |

| Proceeds from share application money pending allotment | 0.0 | 0.0 | 0.9 | 0.0 | 0.0 |

| Proceeds from short term borrowings/ debentures | -37.7 | 0.0 | 0.0 | 0.0 | 0.0 |

| Payment of lease liability | -98.2 | -125.5 | -153.3 | -68.5 | -81.3 |

| Net Interest Paid | -43.6 | -53.8 | -67.4 | -34.9 | -30.2 |

| Net Cash Flow from Financing Activities | -179.5 | -179.2 | -205.1 | -103.4 | -37.4 |

| Net Cash Flow for the Year | 85.6 | -96.4 | 112.0 | -10.4 | -40.5 |

Outlook:

Avenue Supermarts Ltd (DMart) owns and operates India’s most profitable supermarket, DMart. It provides products like Food, Non-Food (FMCG), General Merchandise and apparel through 336 stores, and has managed to maintain its EBITDA margin despite weak SSSG (Same-store sales Growth), thanks to cost-control measures. The expectation is for SSSG to recover in FY24 due to easing inflation and increased store productivity. Despite global economic uncertainties and geopolitical tensions, the domestic economy remains strong due to urbanization, and favorable demographics. In India, the organized grocery retail business penetration is at 4-5%, leaving plenty of headroom for the company to expand. DMart’s strategy focuses on providing quality products at a great value, creating a unique shopping experience for customers. This approach, combined with local market knowledge and supply chain efficiencies, has led to steady growth. Additionally, DMart’s unique strategy of EDLC/EDLP (Everyday Low Cost/Everyday Low Price), coupled with a diverse product range, offers a one-stop shopping solution. The company’s focus on customer needs and competitive pricing has also played a significant role in its success. Despite the uncertain global economic climate, DMart’s future looks promising, thanks to its robust business model and India’s resilient economy. With this in mind, investors are advised to consider Avenue Supermarts as a favorable investment option, particularly for those with a long-term investment horizon. Hence, investors can buy the stock with a target of Rs.4600 for the horizon of 12 months.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Kiran Tahlani, Elite Wealth Limited, kirantahlani@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or e-mailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL

Provided that research analyst or research entity shall not be required to make a disclosure as per sub-clauses (c), (d) and (e) of clause (ii) or sub-clauses (a) and (b) of clause (iii) to the extent such disclosure would reveal material non-public information regarding specific potential future investment banking or merchant banking or brokerage services transactions of the subject company.

(4) EWL or its proprietor has never served as an officer, director or employee of the subject company;

(5) EWL has never been engaged in market making activity for the subject company;

(6) EWL shall provide all other disclosures in research report and public appearance as specified by the Board under any other regulation