Delhivery Limited IPO Company Profile :

Delhivery incorporated on June 22, 2011 is the fastest growing fully-integrated logistics service company in India in term of revenue, company has a very strong network as it is present in 17488 pin code as on December 2021. They have built in-house logistics technology stack which is to meet the dynamic needs of modern supply chains. They have over 80 applications through which they provide various services. Delhivery provides a full range of Logistics services, including delivery of express parcel and heavy goods, TL freight, warehousing, PTL freight, supply chain solutions, freight services, cross-border Express and supply chain software. Delhivery operated 21 fully and semi-automated sortation centers and 82 gateways across India as of December 31, 2021. Delhivery acquired Spoton in August 2021 to further scale their PTL freight services business

| IPO-Note | Delhivery Limited |

| ₹ 462-487 per Equity share | Recommendation: Neutral |

Delhivery Limited IPO Details-

| Issue Details | |

| Objects of the issue | ·Organic Growth Funding

· Funding future Acquisitions. ·General Purposes |

| Issue Size | Total issue Size – ₹ 5235 Cr.

Offer for Sale – ₹ 1235 Cr. Fresh Issue – ₹ 4000 Cr. |

| Face value | ₹ 1.00 Per Equity Share |

| Issue Price | ₹ 462 – 487 |

| Bid Lot | 30 shares |

| Listing at | BSE, NSE |

| Issue Opens: | 11th May, 2022 – 13th May, 2022 |

| QIB | 75% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Delhivery Limited IPO Strengths:

- Delhivery is the largest and the fastest logistics service company In India.

- Delhivery operates a pan-India network and provide their services in 17,488 PIN codes, as of December 31, 2021.

- No of Active customer has increased from 4867 in 2019 to 23113 customer on 31st Dec 2021.

- One of the biggest edge this company has over other logistics companies is the in house technology that they have developed, which help them in meeting dynamic needs of modern supply chain.

- Delhivery collect, structure, store and process vast amounts of transaction and environmental data to guide real-time operational decision making.

Check Delhivery Limited IPO Allotment Status

Go Delhivery Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

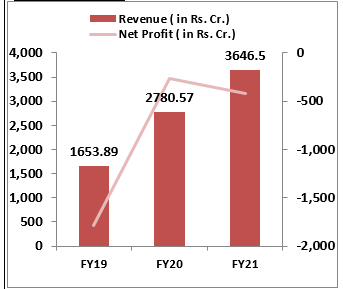

Delhivery Limited IPO Financial Performance:

Delhivery Limited IPO Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | – | – |

| Public | 100% | 100% |

Source: RHP, EWL Research

Delhivery Limited IPO Key Highlights:

- Revenue from operations saw a growth at a CAGR of 48.49% from FY18-21 but has been continuously showing losses, however they are able to reduce their losses from ₹ 1783 cr to ₹ 415 cr in FY21.

- In first nine month of FY22 company made EBITDA loss of ₹ 231.79 crore.

- As of December 31, 2021, Company had total outstanding borrowings of ₹ 3707 crore.

- In FY21 company cash flow from operation was ₹ 4.7 crore and in first 9 moth it is negative ₹ 509 crore.

- In first 9 month of FY22 revenue came in at ₹ 4810 cr saw a growth of 82%.

Delhivery Limited IPO Risk Factors:

- Delhivery is a loss making company, visibility of profit making is still bleak in near future.

- Company is not making profit on EBITDA level, and even making negative cash flow.

- As interest rate is rising, it will become difficult for loss making companies to raise capital in future.

Delhivery Limited IPO Outlook:

Delhivery provides a full range of Logistics services, including delivery of express parcel and heavy goods, warehousing, supply chain solutions, cross border Express, freight services, and supply chain software. The company also offers value-added services such as e-commerce return services, payment collection, installation and processing, and fraud detection service. Delhivery is the largest and fastest-growing fully integrated Logistics services player in India by revenue as of FY21.Delhivery revenue is growing quiet strongly and is able to reduce their losses in last three year but are still not EBITDA positive. As investing environment is deteriorating with the rise in interest rate, and high growth companies are facing the pain, so we are recommending NEUTRAL rating.