NIFTY:

Nifty came under pressure due to global market as it moving near 17500 which is 38 percent correction of recent up move. The index declined almost 4% last week led by weakness in the technology stock . In the US, the Nasdaq Index moved to its lowest levels since June 2021. Midcap and small cap indices also came under pressure as they lost more than 4% each during the week.

We believe volatility will remain higher in the coming week on account of upcoming Union Budget. On the data front, the Put base at 17500 likely to act as an immediate support. It is likely to move towards its previous support 17850 in the coming week. On the higher side, the Call writing at 18000 strike may remain crucial hurdle in the coming sessions

In the coming session, the index is likely to open on a subdued note tracking weak global cues. The formation of lower high-low signifies corrective bias. Hence intraday pullback towards 17775-17802 should be used to create short position for target of 17400.

BANK NIFTY:

For a major part of last week, the Bank Nifty had relatively outperformed the Nifty. However, it failed to give any positive close during the week as cash based selling continued. Private as well as PSU banks continued to witness selling pressure and even HDFC Bank failed to surprise the Street post its quarterly numbers

Numbers are lined up for banks, which should trigger some volatility during the expiry week. The volatility index remained elevated ahead of the Union Budget whereas last week the rupee depreciated and cash based selling by FIIs continued. Rollovers are likely to pick up pace during the week, which should trigger stock specific actions

Buying the decline strategy should work well in coming earnings season as we expect Bank Nifty index to hold strong support of 37500 levels being the confluence of the following technical observations

(a)23.6 % retracement of the current up move (34018 – 38851)

(b)the recent breakout area is placed around 37500 levels In the coming session.

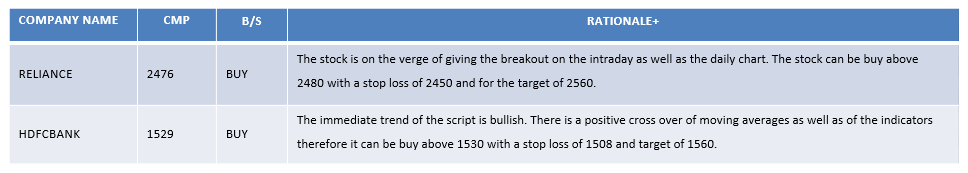

TECHNICAL PICKS

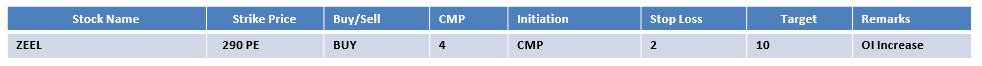

DERIVATIVE PICKS

DERIVATIVE PICKS

TOP DELIVERY PERCENTAGE

TOP DELIVERY PERCENTAGE

| Stocks | Price | %Chg | Total Qty | Delivery | Del % | % Change | ||||

| Sectors | Price | Change % | Quantity | |||||||

| Pfizer Ltd. | 4747.6 | 0 | 21993 | 0 | 86 | Nifty 50 | 17617.15 | -0.79 | 71760 | |

| Tata Consultancy Serv Lt | 3840 | 0.35 | 3111295 | 0 | 80.34 | Nifty Bank | 37574.3 | -0.73 | 71760 | |

| Mahanagar Gas Limited | 852.8 | -2.04 | 534721 | 0 | 74.17 | Nifty it | 36054.55 | -1.66 | 71760 | |

| Petronet Lng Limited | 212.85 | -1.5 | 1344692 | 0 | 74.09 | Nifty Auto | 11561.75 | -0.19 | 71760 | |

| Hdfc Ltd. | 2592.95 | 0.92 | 3952726 | 0 | 72.64 | Nifty Metal | 5719.55 | -1.91 | 71760 | |

| Escorts India Ltd. | 1868.6 | 0.48 | 549498 | 0 | 70.35 | India Vix | 18.89 | 6.18 | 71760 | |

| Max Financial Services l | 933.25 | -4 | 1505907 | 0 | 70.26 | Nifty Realty | 491.2 | -2.36 | 71760 | |

| Honeywell Auto India Ltd | 43863.75 | -2.95 | 5723 | 0 | 69.89 | Nifty Fmcg | 36812.9 | 0.36 | 71760 | |

| Hdfc Bank Ltd. | 1521.6 | 0.83 | 5768339 | 0 | 69.03 | Nifty Pharma | 13243.05 | -1.57 | 71760 | |

| Reliance Industries Ltd | 2477.85 | 0.02 | 6153150 | 0 | 68.58 | Nifty Financial Services | 18047.05 | -0.5 | 71760 | |

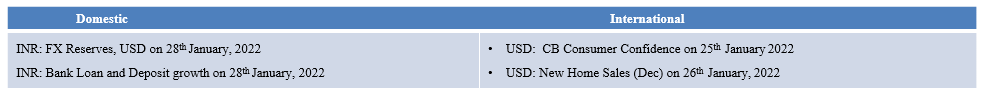

UPCOMING ECONOMIC DATA

NEWS UPDATES

NEWS UPDATES

-

ICICI Bank on Saturday reported a 25 per cent jump in net profit in the October–December quarter (Q3FY22), aided by lower provisions and a robust increase in net interest income (NII). The lender’s net profit in the reporting quarter stood at Rs 6,194 crore, its highest ever quarterly profit, beating Street estimates. Analysts had estimated a net profit of Rs 5,800 crore. Its net interest income rose 23 per cent to Rs 12,236 crore in Q3FY22 as compared to Rs 9,912 crore in the corresponding period of last financial year.

-

YES Bank’s net profit rose by 77 per cent at Rs 266 crore for the third quarter ended December 2021 (Q3FY22) predominantly on reduction in provisions. The net profit was Rs 151 crore in Q3FY21. Sequentially, net profit rose by 18.2 per cent to Rs 225 crore in the second quarter ended September 2021 (Q2FY22).

-

Vodafone Idea Ltd.’s quarterly loss widened owing to an increase in its marketing and finance costs, while roaming and access charges, too, rose. Net loss stood at Rs 7,230.9 crore in the quarter ended December, according to its exchange filing. That compares with the Rs 6,998-crore loss estimate of analysts tracked by Bloomberg.

-

Reliance Industries Ltd.’s quarterly profit surged beating estimates, aided by an increase in benchmark gross refining margins and product cracks, and the performance of its retail segment. The Mukesh Ambani-led conglomerate’s profit rose 41.6% year-on-year to Rs 18,549 crore in the quarter ended December, according to its exchange filing. That compares with the Rs 15,046.7-crore consensus estimate of analysts tracked by Bloomberg. Revenue (minus excise duty) rose 57% over a year earlier to Rs 1,85,047 crore—higher than the estimated Rs 1,75,300 crore.

Source: Economic Times, Indian Express ,Business Today, Livemint, Business Standard, Bloomberg Quint.

BOARD MEETINGS

CORPORATE ACTION

CORPORATE ACTION

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL