Indian Market Outlook:

The Key benchmark indices fell over 1.53 percent on Friday trading session due to continuous selling by FII and concern on Fed, ECB tightening, as US Fed has increased their tapering from $15 Billion to $30 Billion a month and expects to taper down to zero by March 2022, they have also raised their interest rate hike guidance from 2 rate hike to 3 hike next year. Over the week Nifty fell 3 percent as there was continuous selling by FII and market is adjusting to tighter liquidity and hawkish Fed. Sensex ended 3.02 percent lower at 57,011.74 points. Broader market fell higher to the key benchmark indices during the week. BSE Midcap index ended 4.53 percent lower, while the BSE Small cap index fell 2.75 percent. Foreign Institutional Investors were the net sellers during the week; sell equities worth Rs. 10452 crores while the DIIs were the net buyers of Rs. 6341 crores. Bank Nifty fell higher than the Nifty as it fell 4 percent during this week. On Macro front CPI Inflation came in at 4.91% of November month, while WPI inflation hit record high of 14.23%. Going forward market is expected to remain volatile and likely to trade in range bound. We advise investor to be cautious and invest in quality stocks with long term perspective. As upcoming week is going to be Christmas weak, FII activity is going to be subdued. On Macro front USD and UK GDP data would be announced on 22nd December, 2021 On IPO front, Supriya Lifescience IPO is still open and Monday is going to its last date. IPO listing of CE Info System will be on 21stDecember.

Latest Spot Price (in US $)

| Precious Metal | Current Price | Change (%) | 3 Month | 6 Month | 1 Year | |||||

| Gold | 1804.9 | 1.13 | 2.21 | 1.70 | -5.25 | |||||

| Silver | 22.36 | 0.90 | 0.00 | -13.93 | -15.08 | |||||

| Platinum | 927.95 | -2.53 | 2.01 | -13.60 | -11.51 | |||||

| USD/INR | 76.01 | 0.42 | 3.22 | 2.58 | 3.39 | |||||

| Crude | 70.3 | -1.91 | 1.57 | 4.30 | 47.19 | |||||

Global Weekly Events

| Date | Region | Event Description | Forecast | Previous |

| Dec 20,2021 | CNY | PBoC Loan Prime Rate | 3.85% | |

| Dec 21,2021 | GBP | Retail Sales (MoM) (Nov) | 1.00% | 0.8% |

| Dec 22,2021 | GBP | GDP (QoQ) (Q3) | 1.3% | 1.3% |

| Dec 22,2021 | USD | GDP (QoQ) (Q3) | 2.1% | 2.1% |

| Dec 22,2021 | Existing Home Sales (Nov) | 6.50M | 6.34M | |

| Dec 23,2021 | UDS | Initial Jobless Claims | – | 206K |

Domestic Economy Indicators

| Heading | Indicators | Current | Previous |

| RBI Policy Rate | Policy Repo Rate | 4.00% | 4.00% |

| Reverse Repo Rate | 3.35% | 3.35% | |

| Bank Rate | 4.25% | 4.25% | |

| Reserve Ratio | CRR | 4.00% | 4.00% |

| SLR | 18.00% | 18.00% | |

| Inflation Rate | Wholesale Price Index | 14.23% | 12.54% |

| Consumer Price Index | 4.91% | 4.48% | |

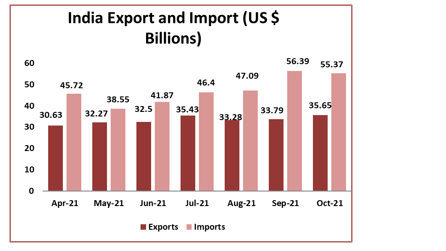

| Trade Data | Export ($ Million) | 30040 | 35650 |

| Import($ Million) | 52940 | 55370 | |

| IIP | 3.2% | 3.1% |

| Domestic Indices | Closing(17rd

Dec) |

Change | %Change |

| BSE Sensex | 57,011.74 | -1,774.93 | -3.02 |

| Nifty | 16,985.20 | -526.10 | -3.00 |

| Mid Cap | 24,542.15 | -1,165.03 | -4.53 |

| Small Cap | 28,455.20 | -805.61 | -2.75 |

| Bank Nifty | 35,618.65 | -1,487.00 | -4.01 |

| Global Indices | Closing (17rd Dec) | Change | %Change |

| Dow Jones | 35,366.56 | -605.42 | -1.68 |

| Nasdaq | 15,169.70 | -460.90 | -2.95 |

| FTSE | 7,269.92 | -21.86 | -0.30 |

| Nikkei | 28,545.68 | 107.91 | 0.38 |

| Hang Seng | 23,192.63 | -803.09 | -3.35 |

| Shanghai Com | 3,632.36 | -33.99 | -0.93 |

| Net Inflow (Cr) | FII | DII |

| 13-Dec-2021 | -2,743.44 | 1,351.03 |

| 14-Dec-2021 | -763.18 | 425.43 |

| 15-Dec-2021 | -3,407.04 | 1,553.01 |

| 16-Dec-2021 | -1,468.71 | 1,533.15 |

| 17-Dec-2021 | -2,069.90 | 1,478.52 |

| Total | -10,452.27 | 6,341.14 |

| Top Gainers | Closing Price | Prev Close | Chg (%) |

| Wipro | 670.80 | 638.25 | 5.10 |

| Power Grid | 209.95 | 202.65 | 3.60 |

| Infosys | 951.15 | 901.80 | 5.47 |

| Tech Mahindra | 1642.80 | 1602.65 | 2.51 |

| Sun Pharma | 768.95 | 761.35 | 1.00 |

| Top Losers | Closing Price | Prev Close | Chg (%) |

| Indiabulls Hsg | 233.15 | 258.80 | -9.91 |

| Yes Bank | 13.15 | 14.45 | -9.00 |

| Bajaj Finserv | 16204.20 | 17711.10 | -8.51 |

| Zee Ent. | 718.35 | 738.75 | -7.72 |

| ITC | 217.95 | 236.10 | -7.69 |

Source: Investing, NDTV, BSE, CNBCTV18, Moneycontrol,

Economic News:

-

Credit Wholesale inflation, measured by the wholesale price index, rose to the highest since 1991 hitting 14.2% in November. Retail inflation, measured by the consumer price index, in contrast, is at a more acceptable level of 4.9%. Not only are the levels of inflation indicated by the two indices widely different, their directions have diverged too. The biggest difference is in the food category. While food accounts for nearly half of the CPI basket, it accounts for a fourth of the WPI basket. Even within the food category, there is a wide difference in weights. For instance, in the CPI basket, cereals have the highest weight at 9.7% of the total basket. Milk and vegetables are the second- and third-largest components at 6.6% and 6%, according to the Ministry of Statistics and Programme Implementation.

-

India’s government is considering changes that would make it easier to lower its stake in state-run banks, a key step in Prime Minister Narendra Modi’s plan to unclog credit flow to the economy. The proposals — if approved — would allow the government to gradually lower its holding in state-run lenders to 26% from 51% without diluting its grip on management appointments, the people said, asking not to be identified as the deliberations are private. They would also simplify privatization of certain identified lenders and permit foreign investors to purchase bigger stakes in others without seeking parliament approval.]

Industry News:

-

As India’s carmakers line up investments in electric vehicles and demand for battery-powered scooters takes off, potential suppliers sense an opportunity. Chemical makers are among them. Two publicly listed companies Neogen Chemicals Ltd. and Gujarat Fluorochemicals Ltd. have prepared capex plans to foray into electric vehicles, according to Edelweiss Broking Ltd. India’s EV market is still nascent with demand mostly coming from two-wheeler segment. India’s rising fuel prices accelerated that shift. But the country’s top automakers including Tata Motors Ltd., Mahindra & Mahindra Ltd. and Hyundai Motor Ltd. have announced investments to build battery-powered capacity. That will also drive demand for supplier of components.

-

As much as Rs 80,000 crore investment is envisaged in setting up city gas infrastructure in 61 geographical areas (GAs), including Jammu, Nagpur, Pathankot and Madurai, that were put on bid in the latest licensing round, oil regulator PNGRB said. Bids for the 65 GAs offered in the 11th city gas licensing round came in on December 15, Petroleum and Natural Gas Regulatory Board (PNGRB) said in a statement.

Company News:

-

Zee Entertainment Enterprises (ZEEL) is in the final stages of completing the due diligence for its proposed merger with Sony Pictures Networks India (SPNI), a subsidiary of Japan’s Sony Corp, as the December 22 deadline draws close. Both companies had entered into a 90-day due diligence process on September 22, following the announcement of a merger. “The due diligence process, which was spread across cities, would be completed ahead of the deadline. This was a large and tedious process started in September, considering both the companies have a presence across the country, and is now nearing closure,” a source close to the development said.

-

India spooks amazon by suspending 2019 future group deal, cites suppression of information. Amazon 2019 future deal was at heart of ongoing legal disputes. India watchdog suspends deal, says amazon suppressed info in2019. Amazon should pay penalty of 2 billion rupees. Suspension of deal latest legal twist in future-amazon saga.

-

IFCI gets shareholders’ approval to raise up to Rs 1,000 cr via bonds. Infrastructure term lender IFCI Ltd on Friday said it has received shareholders’ approval to raise up to Rs 1,000 crore in tranches by issuing various securities.

-

Bharti Airtel has acquired an additional 2.86 per cent in software development firm Vahan. Airtel, via its start-up accelerator programme, aims to support growth of early stage tech startups and partner with them in building significant scale to achieve its vision, the company said in a stock exchange notification.

Global News

-

The South Africa delivered some positive news on the omicron coronavirus variant on Friday, reporting a much lower rate of hospital admissions and signs that the wave of infections may be peaking.

-

Leading central banks made a big call this week, deciding that the coronavirus is no longer calling the shots in their economies, and inflation is now the bigger threat. For almost two years, the main challenge for monetary authorities was to anticipate where the next pandemic blow might fall — and cushion its impact on economic growth and employment.

(Source:Bloomberg Quint, Economic Times, BusinessToday,Business Standard, Financial Express,Investing, Moneycontrol, livemint)

Forthcoming Corporate Actions –20th December –25th December

| Security Name | Ex-Date | Purpose | Security Name | Ex-Date | Purpose |

| BAMBINO | 21-Dec-21 | Final Dividend – Rs. – 1.60 | HINDEVER | 23-Dec-21 | Stock Split From Rs.10/- to Rs.2/- |

| IFINSEC | 22-Dec-21 | E.G.M. | NEOGEN | 23-Dec-21 | E.G.M. |

| POWERGRID | 22-Dec-21 | Interim Dividend – Rs. – 4.00 | PTL | 23-Dec-21 | Stock Split From Rs.2/- to Rs.1/- |

| POWERGRID | 22-Dec-21 | Special Dividend – Rs. – 3.00 | RAJNISH | 23-Dec-21 | Bonus issue 5:4 |

| PRECWIRE | 22-Dec-21 | Stock Split From Rs.5/- to Rs.1/- | RAMINFO | 23-Dec-21 | Interim Dividend – Rs. – 0.50 |

| BCG | 23-Dec-21 | Final Dividend – Rs. – 0.0500 | MANOMAY | 24-Dec-21 | E.G.M. |

| CANFINHOME | 23-Dec-21 | Interim Dividend – Rs. – 1.50 | SHEETAL | 24-Dec-21 | Stock Split From Rs.10/- to Rs.5/- |

| HIKLASS | 23-Dec-21 | Stock Split From Rs.10/- to Rs.5/- |

Source : BSE, Elite wealth Research

Upcoming Key Board Meetings–20th December – 25thDecember

| Symbol | Purpose | BM Date | Symbol | Purpose | BM Date |

| AIIL | General | 21-Dec-21 | RPPINFRA | Right Issue of Equity Shares;General | 22-Dec-21 |

| AMARSEC | General | 21-Dec-21 | SALEM | General | 22-Dec-21 |

| BHANDHOS | Scheme of Arrangement | 21-Dec-21 | TECHNOFAB | Quarterly Results | 22-Dec-21 |

| MKEXIM | Bonus issue;Increase in Auth. Cap. | 21-Dec-21 | BVCL | General | 23-Dec-21 |

| NCLRESE | Right Issue of Equity Shares | 21-Dec-21 | EASTWEST | Issue Of Warrants;Preferential Issue | 23-Dec-21 |

| SAHYADRI | Interim Dividend;General | 21-Dec-21 | EMMSONS | Audited Results | 23-Dec-21 |

| TFL | General | 21-Dec-21 | GAIL | Interim Dividend;General | 23-Dec-21 |

| YESBANK | General | 21-Dec-21 | RADHEDE | General | 23-Dec-21 |

| AMARNATH | General | 22-Dec-21 | SIMPLEX | Audited Results | 23-Dec-21 |

| ANUPAM | Bonus issue;Increase in Auth. Cap. | 22-Dec-21 | TWL | Quarterly Results | 23-Dec-21 |

| BIRLAMONEY | General | 22-Dec-21 | UHZAVERI | Preferential Issue of shares | 23-Dec-21 |

| CEINSYSTECH | General;Preferential Issue of shares | 22-Dec-21 | EQUIPPP | General | 24-Dec-21 |

| DEEPAKNI | General | 22-Dec-21 | RNBDENIMS | General | 24-Dec-21 |

| INTEGRA | Right Issues;Increase in Auth. Cap | 22-Dec-21 | KISAN | Quarterly Results | 25-Dec-21 |

| KUMPFIN | General | 22-Dec-21 | PITHP | General | 25-Dec-21 |

Source: BSE, Elite wealth Research

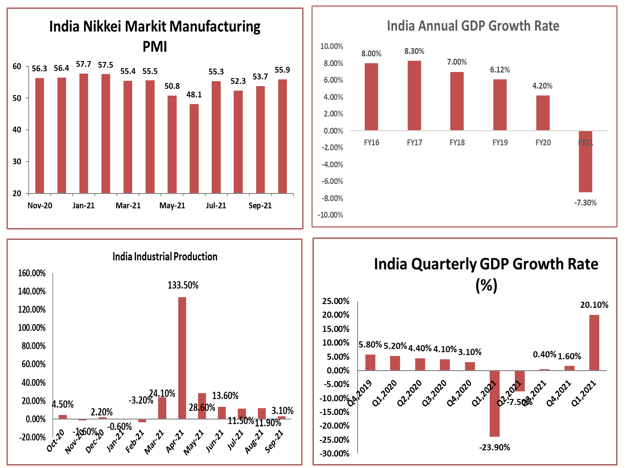

Major Economy Indicators

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL