HDFC Defence Fund NFO

HDFC Asset Management Company Limited (HDFC AMC) is a leading investment manager of HDFC Mutual Fund, which is one of the largest mutual funds in India. Incorporated under the Companies Act, 1956, on December 10, 1999, HDFC AMC was approved by SEBI to act as an Asset Management Company for HDFC Mutual Fund on July 3, 2000. HDFC AMC has a diversified asset class mix across equity and fixed income/others. It also has a widespread network of branches and distribution channels, including banks, mutual fund distributors, and national distributors.

HDFC Asset Management Company Limited is coming up with the HDFC Defence Fund, an NFO scheme with an investment objective to provide long-term capital appreciation by investing predominantly in equity and equity-related securities of Defence & allied sector companies, however, there can be no assurance that the investment objective of the scheme will be achieved. The scheme opens on the 19th of May, 2023, and closes on the 2nd of June, 2023. The scheme reopens for continuous sale and purchase from the 14th of December, 2022.

HDFC Defence Fund NFO Details:

| Mutual Fund: | HDFC Mutual Fund |

| Scheme Name: | HDFC Defence Fund |

| Objective of Scheme: | To provide long-term capital appreciation by investing predominantly in equity and equity-related securities of Defence & allied sector companies, however, there can be no assurance that the investment objective of the scheme will be achieved. |

| Scheme Type: | Open Ended |

| Scheme Category: | Equity Scheme – Sectoral/Thematic |

| New Fund Launch Date: | 19th of May, 2023 |

| New Fund Offer Closure Date: | 2nd of June, 2023 |

| Fund Managers: | Mr. Abhishek Poddar |

| Benchmark Index: | Nifty India Defence Index TRI (Total Returns Index) |

| Minimum Application Amount: | During NFO Period: Purchase: ₹ 100/- and any amount thereafter During the continuous offer period (after scheme re-opens for repurchase and sale): Purchase and additional purchase: ₹ 100/- and any amount thereafter Note: Allotment of units will be done after deduction of applicable stamp duty and transaction charges, if any. |

| Plans: | Regular and Direct |

| Options: | Regular and Direct Plans offer the following sub-options:

· Growth Option · Income Distribution cum Capital Withdrawal (IDCW) Option IDCW option offers following Sub-Options / facilities: · Payout of IDCW Option / facility and · Re-investment of IDCW Option / facility |

| Exit Load: | · In respect of each purchase/switch-in of units, an Exit load of 1% is payable if units are redeemed/switched-out within 1 year from the date of allotment.

· No Exit Load is payable if units are redeemed / switched-out after 1 year from the date of allotment. · No Entry / Exit Load shall be levied on bonus units and Units allotted on Re-investment of Income Distribution cum Capital Withdrawal. · In respect of Systematic Transactions such as SIP, Flex SIP, STP, Flex STP, Swing STP, Exit Load, if any, prevailing on the date of registration / enrolment shall be levied. |

| Minimum Application Amount: | During NFO Period: Purchase:₹ 100/- and any amount thereafter

During continuous offer period (after scheme re-opens for repurchase and sale): Purchase and additional purchase: ₹ 100/- and any amount thereafter Note: Allotment of units will be done after deduction of applicable stamp duty and transaction charges, if any |

HDFC Defence Fund NFO Asset Allocation:

| Instrument | Indicative Allocation ( % of assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity and Equity related instruments of Defence & allied sector Companies# | 80% | 100% | High to Very High |

| Equity and Equity related instruments of companies other than above | 0% | 20% | High to Very High |

| Units of REITs and InvITs | 0% | 10% | Medium to High |

| Debt securities, money market instruments and Fixed Income Derivatives | 0% | 20% | Low to Medium |

| Units of Mutual Fund | 0% | 20% | Low to High |

#Defence & allied sector stocks include:

- Stocks forming part of certain eligible ‘basic industries’ based on AMFI Industry classification including Aerospace & Defence, Explosives, Ship Building & Allied Services as amended from time to time; or

- Stocks from any other defence & allied sectors as per benchmark’s criteria; or

- Stocks present on SIDM (Society of Indian Defence Manufacturers) list; and which obtain at least 10% of revenue from the defence segment as mentioned above.

HDFC Defence Fund NFO Conclusion:

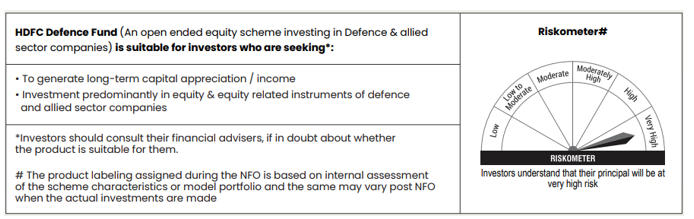

The long-term increase in global defence expenditure is expected to be supported by multipolarity, which will aid in the growth of India’s defence expenditure. India’s strong economic growth and geopolitical considerations are expected to provide a long runway for growth in defence expenditure. India’s focus on self-reliance is expected to increase opportunities for Indian defence players. Research and development focus and manufacturing are expected to help tap global export potential. Indian defence companies have displayed strong order books and growth potential, with healthy balance sheets. However, mid-cap stocks are highly volatile and susceptible to market risk. Therefore, this product is suitable for investors who are seeking long-term capital appreciation and are seeking Investment predominantly in equity and equity-related securities of defence and allied sector companies. Investors may consult with financial advisers at Elite Wealth if in doubt about whether the product is suitable for them.