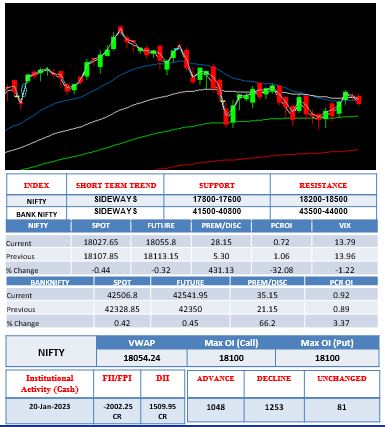

NIFTY:

The NIFTY opened at 18115.60 without much of a change when compared to the last day’s closing price. The index initially went down but soon found support and bounced up. Prices have risen and then faced resistance around 18150 and started drifting downwards after recording its intraday high at 18145.45. The decline continued for the rest of the day. The index recorded its intraday low at 18016.20 and finally closed at 18027.65 near its day’s lows with a loss of 80.20 points or 0.44% down. BANK NIFTY outperformed today and ended with a gain of nearly half percent followed by FINANCIAL. MEDIA underperformed today and ended with a loss of 1.36% followed by MERAL, PHARMA, and FMCG. We were expecting a wide range day and that did not happen. Moreover, the index continued moving sideways inside a wide trading range of 17800- 18250. For this week we were expecting prices to remain within the said boundaries. On the weekly timeframe chart, the index is consolidating for the past four weeks. We may see a breakout in the next couple of weeks, Since the Union Budget is ahead so we may see an increase in volatility. We should now trade with lower volume or avoid trading.

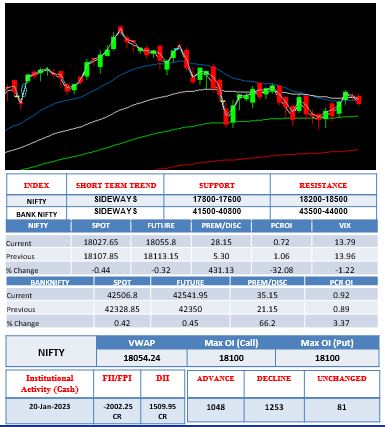

BANK NIFTY:

The BANK NIFTY opened at 425 16.05 with a gap up of 218 points. The index recorded its intraday low at 42366.15 in its initial trades and then saw a sharp upside move towards 42700 resistance. Prices faces resistance around 42700 and then saw a dip after recording its intraday high at 42709.20. The index then formed a trading range and continued moving range bound till the end. Prices finally closed at 42514.05 with a gain of 216 points. PSU BANK has underperformed today and closed without much of a change. PVT BANK has outperformed today and closed with a gain of 0.37% Within the index, in terms of points, HDFC BANK contributed the highest on the upside while KOTAK BANK contributed the lowest. It was again a volatile day where prices again moved very narrowly. The intraday range was just about 343. Moreover, a narrow trading range inside 41700-42700 remained intact. Prices have been moving inside this range for the past 11 trading days. On the weekly timeframe chart, the index is consolidating for the past five weeks. The last two weeks were very narrow suggests the next few weeks may be wide and volatile.

TECHNICAL PICKS

| COMPANY NAME |

CMP |

B/S |

RATIONALE |

| GAIL |

99 |

BUY |

The stock has given a breakout on the intraday as well as the daily chart. The stock can be bought above 99.05 with a stop loss of 98.45 and a target of 100.55. |

| HDFC LIFE |

590.55 |

SELL |

The stock has given a breakdown on the intraday as well as the daily chart. The stock can be sold below 588.20 with a stop loss of 595.70 and a target of 574.70. |

DERIVATIVE PICKS

| Stock Name |

Strike Price |

Buy/Sell |

CMP |

Initiation |

Stop Loss |

Target |

Remarks |

| HAL |

2500 CE |

BUY |

33.95 |

CMP |

21 |

63.50 |

BREAKOUT |

| Long Buildup |

|

Short Buildup |

| Stocks |

Price |

Price% |

OI % |

OI |

|

Stocks |

Price |

Price% |

OI % |

OI |

| FINNIFTY.23.01 Jan |

18816.55 |

0.17 |

11.89 |

21840 |

|

ATUL.23.01 Jan |

7395.4 |

-4.73 |

14.36 |

144525 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Short Covering |

|

Long Unwinding |

| Stocks |

Price |

Price% |

OI % |

OI |

|

Stocks |

Price |

Price% |

OI % |

OI |

| COFORGE.23.01 Jan |

4114.25 |

4.12 |

-20.04 |

609150 |

|

LTTS.23.01 Jan |

3236.3 |

-5.04 |

-31.51 |

830200 |

| HAL.23.01 Jan |

2510.3 |

2.19 |

-21.58 |

2436000 |

|

HAVELLS.23.01 Jan |

1149.9 |

-4.44 |

-24.07 |

3250000 |

| DABUR.23.01 Jan |

567.05 |

2.17 |

-14.14 |

8800000 |

|

PVR.23.01 Jan |

1609.25 |

-4.4 |

-33.97 |

2195358 |

| MANAPPURAM.2301Jan |

115.35 |

1.85 |

-9.99 |

37536000 |

|

TVSMOTOR.23.01 Jan |

972.65 |

-4.1 |

-16.36 |

5614700 |

| INDIAMART.23.01 Jan |

4465 |

1.81 |

-18.93 |

274950 |

|

HINDUNILVR.23.01 Jan |

2552.85 |

-3.64 |

-3.15 |

6736500 |

TOP DELIVERY PERCENTAGE

| Stocks |

Price |

%Chg |

Total Qty |

Delivery |

Del % |

|

|

% Change |

|

|

|

|

|

|

|

Sectors |

Price |

Change % |

Quantity |

| Power Grid Corporation o |

223.25 |

1.13 |

7584484 |

5288196 |

78.2 |

|

Nifty50 |

18027.65 |

-0.44 |

25441234 |

| Hdfc Ltd. |

2715.95 |

0.9 |

1910649 |

1320005 |

74.98 |

|

Niftybank |

42506.8 |

0.42 |

10807270 |

| Kotak Mahindra Bank Limi |

1762.9 |

-0.25 |

4270294 |

3164224 |

74.36 |

|

Nifty it |

29529.65 |

-0.35 |

1442423 |

| Marico Limited |

505.2 |

0.77 |

3298721 |

2691369 |

73.78 |

|

India Vix |

13.79 |

-1.22 |

330189730 |

| Godrej Cons Products Ltd |

932.4 |

0.34 |

1616181 |

991690 |

73.76 |

|

Nifty Fmcg |

43899.6 |

-0.96 |

599839 |

| Piind |

3238.15 |

-0.34 |

75378 |

38597 |

72.46 |

|

Nifty Pharma |

12606.45 |

-0.73 |

36325385 |

| Itc Ltd. |

334.6 |

0.74 |

13103664 |

9744145 |

72.14 |

|

Nifty Realty |

427.45 |

-0.72 |

1072060821 |

| Tata Consultancy Serv Lt |

3363.1 |

-0.3 |

1529349 |

1142015 |

71.73 |

|

Nifty Auto |

12691.7 |

-0.56 |

36107910 |

| Shriram Finance Limited |

1277.3 |

-1.35 |

396914 |

252229 |

70.55 |

|

Nifty Metal |

6805.25 |

-0.9 |

67238882 |

| Infosys Limited |

1525.55 |

-0.87 |

6496429 |

5166082 |

69.85 |

|

Nifty Financial Services |

18772.4 |

0.17 |

3481312 |

UPCOMING ECONOMIC DATA

| Domestic International |

| INR: Nikkei S&P Global Manufacturing PMI (Jan) on 1st February, 2023

INR: Union Budget 2023-24 on 1st February, 2023 |

USD: Crude Oil Inventories on 25th January, 2023

USD: GDP (QoQ) (Q4) on 26th January, 2023 |

NEWS UPDATES

- Benchmark indices ended lower in yet another volatile session on January 20.At Close, the Sensex was down 236.66 points or 0.39% at 60,621.77, and the Nifty was down 80.10 points or 0.44% at 18,027.70. About 1533 shares have advanced, 1865 shares declined, and 146 shares are unchanged.

- HDFC Life Insurance Company Ltd on January 20 reported a 15 percent increase in its net profit to Rs 315.22 crore for the December quarter of the financial year 2022-23 on the back of strong new business growth.For the December quarter, the value of the new business was Rs 875 crore, beating street expectations.

- JSW Steel on January 20 reported a 85.50 percent year-on-year (YoY) decrease in consolidated net profit for the quarter ended December 2022 at Rs 474 crore. The steelmaker reported a profit of Rs 4,516 crore in the same quarter of the previous financial year.

- UltraTech Cement is expected to report better volumes and a recovery in sales but profit is expected to dip when it reports its December quarter numbers on January 21.UltraTech Cement’s consolidated revenue is likely to rise by 19.5 percent year on year (YoY) and 11.7 percent quarter on quarter (QoQ) to Rs 15,191.5 crore, according to a brokerage poll conducted by Moneycontrol..

Source: Economic Times, Indian Express, Business Today, Livemint, Business Standard, Bloomberg Quint

BOARD MEETINGS

| Company Name |

Purpose |

Meeting Date |

Company Name |

Purpose |

Meeting Date |

| ABANSENT |

Quarterly Results |

23-Jan-23 |

LIKHAMI |

General;Quarterly Results |

23-Jan-23 |

| ADITYA |

General |

23-Jan-23 |

MAHSEAMLES |

Quarterly Results |

23-Jan-23 |

| AMBER |

Quarterly Results |

23-Jan-23 |

MAYUKH |

Quarterly Results |

23-Jan-23 |

| ARVSMART |

Quarterly Results |

23-Jan-23 |

MERCTRD |

Quarterly Results |

23-Jan-23 |

| ASHRAM |

General |

23-Jan-23 |

NILASPACES |

Quarterly Results |

23-Jan-23 |

| AVANTEL |

Quarterly Results |

23-Jan-23 |

NRAGRINDQ |

Quarterly Results |

23-Jan-23 |

| AXISBANK |

Quarterly Results |

23-Jan-23 |

OMAXAUTO |

Quarterly Results |

23-Jan-23 |

| BBL |

Quarterly Results |

23-Jan-23 |

ORBTEXP |

Quarterly Results |

23-Jan-23 |

| BHARATSE |

Quarterly Results |

23-Jan-23 |

ORIENTHOT |

Quarterly Results |

23-Jan-23 |

| BRNL |

Quarterly Results |

23-Jan-23 |

PNBGILTS |

Quarterly Results |

23-Jan-23 |

| BUTTERFLY |

Quarterly Results |

23-Jan-23 |

POONAWALLA |

Quarterly Results |

23-Jan-23 |

| CANBK |

Quarterly Results |

23-Jan-23 |

PRUDENT |

Quarterly Results |

23-Jan-23 |

| COMPUAGE |

Quarterly Results |

23-Jan-23 |

RAJGLOWIR |

General;Quarterly Results |

23-Jan-23 |

| CONCOR |

Interim Dividend;General;Quarterly Results |

23-Jan-23 |

ROUTE |

Quarterly Results |

23-Jan-23 |

| CRAFTSMAN |

General;Quarterly Results |

23-Jan-23 |

RTNPOWER |

Quarterly Results |

23-Jan-23 |

| DBOL |

Quarterly Results |

23-Jan-23 |

SAGCEM |

Quarterly Results |

23-Jan-23 |

| DCXINDIA |

Quarterly Results |

23-Jan-23 |

SAPL |

Quarterly Results |

23-Jan-23 |

| DUCON |

Quarterly Results |

23-Jan-23 |

SATIN |

Quarterly Results |

23-Jan-23 |

| EDVENSWA |

General |

23-Jan-23 |

SCAPDVR |

Preferential Issue of shares;Quarterly Results |

23-Jan-23 |

| EIMCOELECO |

Quarterly Results |

23-Jan-23 |

SELAN |

Quarterly Results |

23-Jan-23 |

| GCKL |

Quarterly Results |

23-Jan-23 |

SHAREINDIA |

Interim Dividend;Quarterly Results |

23-Jan-23 |

| GLAND |

Quarterly Results |

23-Jan-23 |

SHOPERSTOP |

General;Quarterly Results |

23-Jan-23 |

| GRADIENTE |

Quarterly Results |

23-Jan-23 |

SPLPETRO |

Quarterly Results |

23-Jan-23 |

| GRAVITA |

Quarterly Results |

23-Jan-23 |

STAMPEDE |

Preferential Issue of shares;Quarterly Results |

23-Jan-23 |

| HFCL |

Quarterly Results |

23-Jan-23 |

STEELCAS |

Interim Dividend;Quarterly Results |

23-Jan-23 |

| IDBI |

Quarterly Results |

23-Jan-23 |

SYNGENE |

Quarterly Results |

23-Jan-23 |

| IIFLSEC |

Interim Dividend;Quarterly Results |

23-Jan-23 |

TATACOMM |

Quarterly Results |

23-Jan-23 |

| J&KBANK |

General;Quarterly Results |

23-Jan-23 |

TCFCFINQ |

Quarterly Results |

23-Jan-23 |

| JAIMATAG |

Quarterly Results |

23-Jan-23 |

THANGAMAYL |

Interim Dividend;Quarterly Results |

23-Jan-23 |

| JINDRILL |

Quarterly Results |

23-Jan-23 |

TIPSINDLTD |

Quarterly Results |

23-Jan-23 |

| JSL |

General;Quarterly Results |

23-Jan-23 |

TMB |

Quarterly Results |

23-Jan-23 |

| JSLHISAR |

Quarterly Results |

23-Jan-23 |

TRITURBINE |

Quarterly Results |

23-Jan-23 |

| KEI |

Interim Dividend;Quarterly Results |

23-Jan-23 |

TSPIRITUAL |

General;Quarterly Results |

23-Jan-23 |

| KHAICHEM |

Quarterly Results |

23-Jan-23 |

VRFILMS |

Bonus issue;General |

23-Jan-23 |

| LASTMILE |

Preferential Issue of shares |

23-Jan-23 |

ZENSARTECH |

Interim Dividend;Quarterly Results |

23-Jan-23 |

CORPORATE ACTION

| Company Name |

Ex-Date |

Purpose |

Company Name |

Ex-Date |

Purpose |

| ANGELONE |

24-Jan-23 |

Interim Dividend – Rs. – 9.6000 |

WENDT |

31-Jan-23 |

Interim Dividend – Rs. – 30.0000 |

| CARGOSOL |

24-Jan-23 |

E.G.M. |

ACGL |

01-Feb-23 |

Interim Dividend – Rs. – 2.5000 |

| GOTHIPL |

24-Jan-23 |

Interim Dividend – Rs. – 2.0000 |

DCMSHRIRAM |

01-Feb-23 |

Interim Dividend |

| PRECWIRE |

24-Jan-23 |

E.G.M. |

MASTEK |

01-Feb-23 |

Interim Dividend – Rs. – 7.0000 |

| WIPRO |

24-Jan-23 |

Interim Dividend – Rs. – 1.0000 |

MFL |

01-Feb-23 |

Interim Dividend – Rs. – 2.5000 |

| HAVELLS |

25-Jan-23 |

Interim Dividend – Rs. – 3.0000 |

SHAREINDIA |

01-Feb-23 |

Interim Dividend |

| NATIONALUM |

25-Jan-23 |

Interim Dividend – Rs. – 1.0000 |

THANGAMAYL |

01-Feb-23 |

Interim Dividend |

| PERSISTENT |

25-Jan-23 |

Interim Dividend – Rs. – 28.0000 |

ZENITHEXPO |

01-Feb-23 |

E.G.M. |

| ABIRAFN |

27-Jan-23 |

Buy Back of Shares |

ACCELYA |

02-Feb-23 |

Interim Dividend |

| HINDZINC |

27-Jan-23 |

Interim Dividend – Rs. – 13.0000 |

SHUKRAPHAR |

02-Feb-23 |

Right Issue of Equity Shares |

| METROBRAND |

27-Jan-23 |

Interim Dividend – Rs. – 2.5000 |

TANAA |

02-Feb-23 |

Interim Dividend |

| PBAINFRA |

27-Jan-23 |

E.G.M. |

IIFLSEC |

03-Feb-23 |

Interim Dividend |

| PGINVIT |

27-Jan-23 |

Income Distribution (InvIT) |

SUNCLAYLTD |

03-Feb-23 |

Interim Dividend |

| SURYAROSNI |

27-Jan-23 |

Interim Dividend – Rs. – 3.0000 |

VAIBHAVGBL |

03-Feb-23 |

Interim Dividend |

| ASCENSIVE |

30-Jan-23 |

E.G.M. |

ZENSARTECH |

03-Feb-23 |

Interim Dividend |

| BANARBEADS |

30-Jan-23 |

Interim Dividend – Rs. – 2.0000 |

SIYSIL |

06-Feb-23 |

Interim Dividend |

| BAZELINTER |

30-Jan-23 |

E.G.M. |

TCI |

07-Feb-23 |

Interim Dividend |

| IIFLWAM |

30-Jan-23 |

Interim Dividend – Rs. – 17.0000 |

GILLETTE |

09-Feb-23 |

Interim Dividend |

| LTIM |

30-Jan-23 |

Interim Dividend |

ENGINERSIN |

13-Feb-23 |

Interim Dividend |

| SIEMENS |

30-Jan-23 |

Final Dividend – Rs. – 10.0000 |

PGHL |

13-Feb-23 |

Interim Dividend |

| CCL |

31-Jan-23 |

Interim Dividend – Rs. – 3.0000 |

TVTODAY |

13-Feb-23 |

Interim Dividend |

| MONIND |

31-Jan-23 |

E.G.M. |

CAMS |

15-Feb-23 |

Interim Dividend |

| RKFORGE |

31-Jan-23 |

Dividend |

STL |

15-Feb-23 |

Stock Split From Rs.10/- to Rs.2/- |

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL